1. Introduction

When people talk about Mutual Funds, SIP comes to mind. The term SIP has been popularized through various investor awareness outreach programs with due credit to AMFI’s ‘Mutual Fund Sahi Hai’ drive. The campaign not only aims to position mutual funds as a preferred investment option for potential investors but also to entice them to adopt SIP with monthly payments as low as Rs. 500 per month.

But let’s take a few steps back here and understand the concept of SIP.

Mutual funds come with the option of investing through Systematic Investment Plan (SIP). Previously to invest in mutual funds you had to make a one-time investment of a considerable sum of money. Through the SIP mode of investing, investors can invest small amounts of money regularly in any mutual fund scheme. SIP can be set for the chosen intervals as per your convenience like weekly, monthly, quarterly. The most preferred SIP is monthly. It helps them to spread out their investments in the mutual fund schemes over a period of time. This makes it affordable for almost everyone and aims at tapping a larger number of small investors.

Through RankMF knowledge center, we aim to educate you about the basics of mutual funds and all the information and details about mutual funds you will need. Before you begin investing through mutual funds in India, it is essential to know the basics of SIP.

2. Mutual Fund Industry: SIP Overview

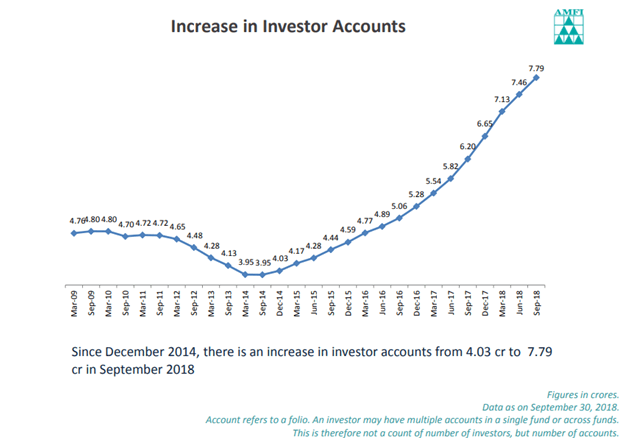

The Indian Mutual Fund industry has grown from AUM of Rs. 22.60 trillion in December 2017 to AUM of Rs. 24.09 trillion in December 2018. That represents a 6.55% growth in assets over December 2017. It currently has about 2.54 crore (25.4 million) SIP accounts. AMFI data shows that the MF industry had added about 9.46 lacs SIP accounts each month on an average during the FY 2018-19, with an average SIP size of about Rs. 3,150 per SIP account.

| Month | SIP Contribution (Rs. in crore) | ||

| FY 2018-19 | FY 2017-18 | FY 2016-17 | |

| Total during FY | 68,479 | 67,190 | 43,921 |

| March | N.A. | 7,119 | 4,335 |

| February | N.A. | 6,425 | 4,050 |

| January | N.A. | 6,644 | 4,095 |

| December | 8,022 | 6,222 | 3,973 |

| November | 7,985 | 5,893 | 3,884 |

| October | 7,985 | 5,621 | 3,434 |

| September | 7,727 | 5,516 | 3,698 |

| August | 7,658 | 5,206 | 3,497 |

| July | 7,554 | 4,947 | 3,334 |

| Jun | 7,554 | 4,744 | 3,310 |

Source: AMFI

SIP has come a long way and is now gaining momentum which is witnessed from the data above. The total amount collected through SIP during December 2018 was Rs. 8,022 crore, an all-time high despite volatile markets.

More participation of individual investors through SIP has now led them to hold a higher share of industry assets, i.e. 53.6% in December 2018, compared with 50.6% in December 2017. The value of individual assets increased from Rs.11.44 lakh cr. in Dec 2017 to Rs.12.91 lakh cr. in Dec 2018, an increase of 12.86%.

Net inflow in equity schemes has been Rs. 11,422 cr. for Oct 2018, Rs. 7579 cr. for Nov 2018 and Rs. 5765 cr. for Dec 2018. Net inflows in equity schemes for the year have been Rs. 81,211 cr. The retail investors have continued to remain resilient with SIP flows in equity mutual funds unaffected by weakness in the markets.

3. The Concept of SIP

A. What is a SIP?

A SIP allows you to invest a certain fixed amount based on your investing requirements at regular intervals which can be:

- Quarterly

- Monthly

- Weekly

in a mutual fund scheme either for a pre-determined period or perpetually. In SIP, a fixed amount is deducted from your bank account on a particular date every month and directed towards the mutual fund you have chosen to invest in. To read more about SIP, click on What is a SIP?

B. How does SIP work?

Daily the stock markets bring opportunities for unprecedented gains for the watchful investors. You often hesitate to take advantage of these opportunities due to a variety of reasons such as lacking knowledge of markets, market volatility, trade/investment losses, analysis paralysis, etc. to name a few. SIP gets rid of this predicament and disperses your investments without relying on the index movement. Furthermore, it helps you mix up your price exposure in the mutual fund scheme of your choice. The two methods that would greatly benefit you under the SIP route are – Rupee Cost of Averaging and Power of Compounding.

1. Rupee Cost Averaging:

Let us understand rupee-cost averaging with an example. Let’s assume you are investing Rs. 500 per month for a year. Now check the average cost per unit under the SIP mode and the Lump sum mode. As you can see the average cost is lower than the average price at which the units were bought under the lump sum mode.

| Month | SIP | Lump sum | |||||

| NAV (Rs.) | Monthly Investment made in SIP (Rs.) | No. of units | Avg. Cost per unit | One time investment made under Lump sum (Rs.) | No. of units | Avg. Cost per unit | |

| Jan | 15 | 500 | 33 | Rs. 12.67 | 6000 | 400 | Rs. 15 |

| Feb | 12 | 500 | 42 | ||||

| Mar | 10 | 500 | 50 | ||||

| Apr | 12 | 500 | 41 | ||||

| May | 15 | 500 | 34 | ||||

| Jun | 12 | 500 | 42 | ||||

| Jul | 15 | 500 | 33 | ||||

| Aug | 12 | 500 | 42 | ||||

| Sep | 10 | 500 | 50 | ||||

| Oct | 12 | 500 | 41 | ||||

| Nov | 15 | 500 | 34 | ||||

| Dec | 12 | 500 | 42 | ||||

| Total | 6000 | 484 | 6000 | ||||

Through SIP investment, you get more units when the markets are lagging and fewer units when markets are booming. This is explained in the example above, where the investor has two options for investment – SIP and lump sum. If he invests Rs. 6000 through the lump sum mode, he makes the investment at the beginning of the year i.e. in the month of January and gets 400 units at once at a NAV of Rs. 15. If the investor invests through the SIP mode, he makes a monthly SIP payment of Rs. 500 (Rs. 500 x 12 months = Rs. 6000). In the month of January when the NAV is higher i.e. Rs. 15, he gets 33 units in that month whereas when the NAV is lower as it is in the month of March – Rs. 10, he gets more units in that month i.e. 50 units for the same SIP amount of Rs. 500. Throughout the year he makes a fixed monthly investment of Rs. 500 and gets units as per the NAV on the date of investment. At the end of the year, his average cost per unit comes down to Rs. 12.67 and he holds 484 units which is higher than what he would hold under the lump sum mode. As the NAV fluctuates during the year, you can benefit from the rupee-cost averaging which brings down the cost per unit. However, under lump sum mode, you don’t get this benefit as you buy all the units in one-time investment and you get those units at the prevailing NAV which if higher could get you lower units.

This is how rupee-cost averaging helps you get immune to the market whipsaws and to average your purchase cost and maximize returns. But you, as an investor, are bound to the regiment of saving in a regular manner. This style of investing, balloons your units in the scheme at a lower average purchasing cost.

2. Effect of Compounding:

The concept of compound interest is that interest is added back to the principal sum so that interest is earned on that added interest during the next compounding period. The longer the tenure the higher the fund value would be. If you stay invested for a longer period you accumulate more wealth with the power of compounding. The table below will help you understand how the compounding effect will help you to maximize returns over a longer period.

| Year-end | Simple Interest @10%

|

Compounding Interest @10%

|

||

| Principal | Interest | Principal | Interest | |

| 1 | 100 | 10 | 100 | 10 |

| 2 | 100 | 10 | 110 | 11 |

| 3 | 100 | 10 | 121 | 12.1 |

| 4 | 100 | 10 | 133.1 | 13.3 |

| 5 | 100 | 10 | 146.41 | 14.6 |

| 6 | 100 | 10 | 161.05 | 16.1 |

| 7 | 100 | 10 | 177.15 | 17.7 |

| 8 | 100 | 10 | 194.87 | 19.5 |

| Total | 80 | 114.5 | ||

To get the best out of your investments, it is very important to invest for the long-term, which means that you should start investing early, in order to maximize the end returns.

Let’s understand this better through another illustration –

Let’s assume that two friends, both aged 25, decide to invest Rs. 5000 every month for a period of 5 years and earn 10% p.a. on a monthly compounding basis. The only difference is that while one starts investing promptly at the age of 25 itself, the other starts investing 10 years later at the age of 35 years. Both decide to hold on to their investments until they turn 60. So while both of them would accumulate principal investment of Rs. 3 Lakh over a period of 5 years, the investment of the person who started early at the age of 25 appreciates to Rs. 20 Lakh at the age of 40, whereas the investment of the second person who started at 35 grows to only about Rs. 4 Lakh at the age of 40.

C. SIP Investment Process:

1. How to Start an Investment through SIP?

Easy SIP Investment through RankMF

Step 1: Open an Account and Login on RankMF

Step 2: Complete your KYC Procedure for A/c opening. Or if already a client, go to Step 3

Step 3: Decide your Financial Goals, Risk Appetite and Investment Horizon

Step 4: Choose Fund for SIP – Equity, Debt, Hybrid, ELSS based on our rankings and ratings

Step 5: Decide SIP Installment Amount, SIP Frequency (monthly, quarterly, half-yearly) and SIP Date

Step 6: Make Payment through Bank A/c or Samco Demat A/c

Step 7: Track regular SIP payments and watch Investments grow!

At RankMF, we provide an online investment platform wherein we rate and rank all the mutual funds’ schemes. We evaluate every mutual fund and help investors select the best mutual funds out there.

2. How is Investor’s money invested?

SIPs allow you to invest a small amount of money periodically (quarterly, monthly, weekly) into a selected mutual fund. This process is explained in the image above. The investor is shown making a quarterly SIP investment of a pre-determined amount at the start of every quarter – January, April, June and September. The SIP amount gets invested in the selected scheme every quarter and units are purchased at the prevailing NAV and added in the investor’s account. The investor benefits from the rupee-cost averaging and power of compounding as already explained above and makes gains for himself at the end of the year. With a systematic investment plan, he is thereby able to achieve his life goals in the end.

4. SIP Calculator

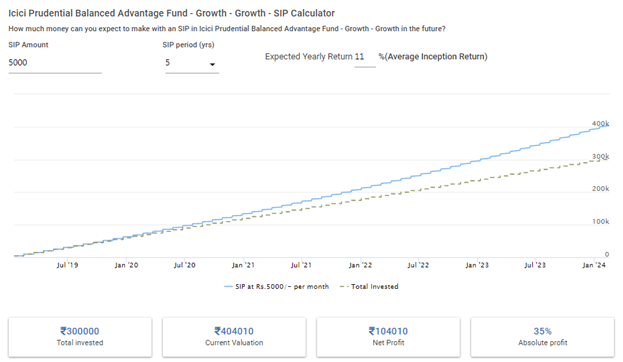

The SIP calculator helps you get a rough estimate of the capital you would’ve made and the expected returns for your monthly SIP investment, based on the projected annual rate of return. SIP returns are calculated according to compound interest. On RankMF, every fund’s scheme is furnished with a SIP calculator.

You need to input your monthly SIP amount, set the investment period, the expected Annual Returns (%) and adjust the same for future inflation.

Here’s what a SIP calculator looks like. We’ve considered the SIP calculator for the scheme of ICICI Prudential Balanced Advantage Fund. This shows the returns compiled if the monthly amount of Rs.5000 was invested for 5 years, with an expected average yearly return of 11%.

Source: RankMF

The blue line is your returns, ballooned over the years, and the green line is the amount you’ve invested in the 5-year period. The SIP calculator allows you to adjust the SIP amount, period and even the expected yearly return. It shows you the total invested amount for the period of 5 years i.e. 60 monthly SIP payments, Net Profit at an expected average yearly rate of 11% in absolute and relative terms and total valuation. Thus the SIP calculator empowers investors in their financial planning in a smart way.

5. Types of SIP

- Flexible SIP: With this, you can adjust your payments the way you want. You can choose to skip one or more payments or make a bigger contribution to your SIP account.

- Pause SIP: This facility allows you to pause your SIP plan during periods of financial distress for a while and resume once normalcy returns.

- Perpetual SIP: SIP investments are generally for a fixed period of 1 year, 3 years, 5 years or until a financial goal is met. Under Perpetual SIP, you don’t mention the end date in the mandate. This SIP allows you to redeem your funds whenever required or particularly when the goal is met.

- Alert/Trigger SIP: With Trigger SIP, you can set either an index level, NAV, date or an event and take advantage of the anticipated movements. A trigger will activate a transaction/alert when the event selected for. For example, if the market is down by 500 points or 2-5 percent, an alert is sent to the investor.

6. SIP related investor questions answered:

§ What is the right amount for your SIP?

The SIP amount is subjective meaning it would differ from person to person depending upon their financial goals, risk appetite and investment horizon. Based on the corpus you want to build and your future requirements, you can use a SIP calculator to determine the right amount of SIP investment to meet those goals.

§ Can you increase or decrease SIP amount?

SIP comes with various facilities such as Top-up/Step-up SIP which gives you the option to increase the SIP amount as and when required. For that, you need to set up a step-up mandate at the start of your SIP investment wherein you can fix any amount of increase – by percentage or by Rupee amount – to happen every 6 months, 18 months, or any other fixed duration. SIP amount in an existing scheme cannot be decreased. It is advisable to close the existing SIP scheme and start a new one at a reduced amount instead.

§ Can you add lump sum to SIP?

If you are already investing in a scheme via SIP, you can still make a lump sum in the same scheme which gets added to the invested amount. For example, Mr. A invests Rs.5,000 every month through SIP into a mutual fund scheme since January 2018. In September 2018 he gets a bonus of Rs.50,000, he can invest this into the same mutual fund scheme on which he has the active SIP. Making a lump sum payment at any time doesn’t affect your SIP payments.

§ Is SIP tax-free?

SIP is one of the routes for investment in mutual funds. It is not SIP that is tax-free but the fund that you invest in that makes it tax-free. Currently investing in ELSS makes you eligible for tax deduction up to Rs.1,50,000 under section 80C of IT, 1961.

§ What if you miss my SIP payment?

When you miss a SIP payment, your SIP installment will not get deducted in that month. You are not charged any penalty by the AMC neither does your account get de-activated. However, your bank may penalize you for not maintaining sufficient funds for auto-debit mandate through Electronic Clearing Service (ECS). Banks have their own set of charges for ECS rejection, which range from Rs. 150 to Rs. 750. If you miss three consecutive SIP payments, then it will be considered that you aren’t willing to continue your investments and it will be automatically terminated. In such cases, it is advisable to use the Pause SIP facility which allows you to stop or pause SIP payments due to insufficient funds.

§ Does SIP have a lock-in period?

The lock-in period is applicable to every Systematic Investment Plan (SIP) installment in an ELSS (Equity Linked Saving Scheme) and certain Retirement funds. Under ELSS or tax saving scheme the lock-in period is for 3 years whereas for certain Retirement schemes the lock-in period is 5 years.

§ For how long you can invest in a SIP plan?

A SIP investment can be made for a minimum period of six months. At the start of SIP, you can choose any tenure you wish or you may even opt for the ‘perpetual option’, which means the SIP will continue till you give an instruction to the AMC to close it. Another way of deciding the tenure is by linking each SIP to a goal and continuing with it until the goal is achieved.

7. Conclusion:

Why invest through SIP?

To sum up, SIP looks out for your convenience. With the option of automated payments, you don’t have to remember to make payments every month. Moreover, it eliminates the mental load of deciding what the right time to invest is or how to time the markets to make profits. If truth be told, there is no way to predict these things. By delaying your investments you are missing out on one of the most precious resources, time. All you need to do is systematically invest from time to time which will then take you to your end goal. SIP makes it very easy for you. It instills financial discipline in your life and disperses your investments without relying on the market swings or the index movement. It comes along with numerous benefits. So why not take advantage of a valuable tool as this – structure your plans, start investing early and achieve your long-term financial goals.

This covers the vast subject of how mutual funds work. For more useful articles on Mutual Funds, trading, investing and market knowledge, visit our Investor Education section.

(Note: This content is for information purpose only Avoid trading and investing based on the information given above. Before investing in stocks or mutual funds, please conduct proper due diligence.)

Leave A Comment?