Introduction of Step Up SIP

SIP has been a popular investment tool among maximum investors in the mutual fund industry. Investors are required to invest specific amounts at fixed intervals, acting as a steady medium for wealth creation. Over the years, SIPs have made it simple for investors to meet their financial goals as it inculcated a systematic discipline among them and enabled them with a better sense of financial independence.

If the individual keeps making progress in their business or job, their monetary growth also sees an uptick. With time, we have realised that investors need a new tool, which is smart and efficient enough to bring in consistent growth. And keeping this in mind, we are introducing Step Up SIP from RankMF – an investment tool which can help investors achieve their financial goals sooner than expected.

What is Step Up SIP?

RankMF’s Step Up SIP is an investment tool which increases your SIP base amount by specific percentage or by an absolute value on a predetermined tenure. It is similar to the process of Systematic Investment Plan i.e. SIP, where an investor’s goal, risk tolerance, time horizon are considered when selecting mutual fund schemes.

The only additional leg to Step Up SIP is investors are required to specify their Step Up percentage or amount, according to which their SIP will be topped up respectively. This automated feature not only maintains an investment discipline, but also curbs the unwanted and impulsive habit of investing in low-return schemes.

Advantages of Step Up SIP

1. Synchronise the income growth with investment growth

When there is growth in income, usually, investors hastily spend the funds on tangible products, which might not be the wisest investment objective. This purchase can satisfy their desires for the time being, but its value keeps depreciating over time.

To keep the momentum of your financial growth going, it is crucial for your investment to grow as well. RankMF’s Step Up SIP can endeavour to grow investors’ wealth by increasing their SIP base amount by a minimum of 10%.

2. The Power Of Compounding

With SIP, investors get the benefit of compounding, i.e the interest earned annually are reinvested every year, and as a result, this multiplier effect becomes a robust aspect of SIPs. Topping up the investments on an annual basis can be rewarding as it generates higher returns, hence bringing you one step closer to your financial goal.

3. Beats the Inflation

The rise in inflation also raises the cost of living. In a developing nation like India, the purchasing power today will not remain the same in the next ten years. But investing in mutual funds with Step Up SIP can be one of the investment options, which can help you during uncertain times of inflation.

Example

Meera and Radha have always been best friends. They completed their education together and started a restaurant as partners. Initially, the income was unstable because of the pandemic, but post-pandemic, their business boomed, hence generating a stable income every month.

Pandemic taught them that uncertainties can arise unexpectedly and they should be prepared to face it. Since they had a stable income source now, Radha decided to invest one fourth of her income in a mutual fund via SIPs. She also suggested the same to Meera.

While researching on mutual funds, Radha came across RankMF’s Step Up SIP investment tools. She was impressed with the concept of topping up the base SIP amount annually, so that she can reach her goal of wealth creation fast. Like always, Radha also tried to convince her friend to invest via Step Up SIP.

But Meera seemed hesitant about the stepping up process, so Radha suggested her to invest in an SIP instead. Both invested in their SIP religiously, and as decided Radha stepped up her SIP amount by 10 % every year.

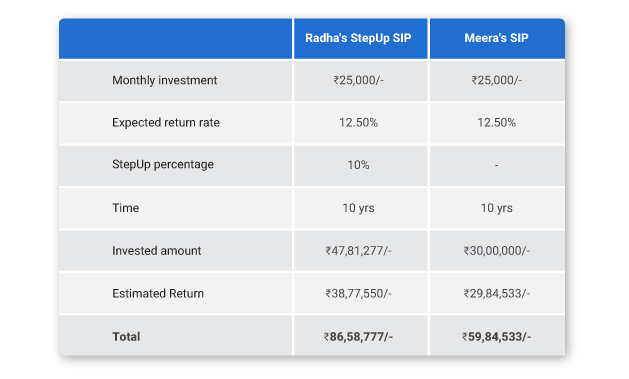

Eventually, their investment grew like this:

With RankMF’s Step Up SIP, Radha was able to build corpus up to 45% more compared to Meera’s invested corpus.

Difference between SIP and Step Up SIP

The only difference Step Up SIP has with respect to SIP, is that the Systematic Investment Plan has a fixed amount that is meant to be invested on a specified date. Step Up SIP allows investors to increase their base SIP amount on a fixed time horizon, hence building a larger corpus compared to conventional SIP.

Step Up SIP encourages investment discipline, so that investors achieve their financial goal without fearing for financial restrictions in future.

How to invest through RankMF’s Step Up SIP?

- Login to your RankMF account

- Click on the mutual fund scheme you want to invest in

- Choose the Step Up SIP option

- Fix your Step Up percentage or amount with tenure.

- Your Step Up SIP is registered!

Conclusion

Maximum mutual fund Investors opt for SIP, because of its affordability, diversification and professional management. Moreover, SIPs are affordable and don’t pose a burden on investors over a long run and can grow the wealth at a moderate pace.

Step Up SIP is created with the best interest, to sync investment growth with income growth. It also gives investors maximum exposure to the mutual fund industry and boosts their wealth creation journey.

*Mutual Funds are subject to market risk. Read scheme related documents carefully.

FAQ for Step Up SIP-

1. How to Invest in Step Up SIP?

Ans: An investor needs to login to their RankMF account and then click on the mutual fund scheme that they want to invest in. After that, they need to choose the Step Up SIP option and fix their Step Up percentage, amount and tenure. Once this is done, all they need to do in the final step is to complete the payment.

2. Are Step Up SIP good?

Yes, with Step Up SIP investors can synchronise their income growth with investment growth.And the power of compounding also helps to generate better returns and in beating the inflation over the long run.

3. When can you open Step Up SIP?

When there is stable income growth, you can start your Step Up SIP.

Leave A Comment?