Is your money lying idle in your account and growing slower than the inflation rate? Wouldn’t you like to revamp your portfolio returns for a better tomorrow? So take charge of your money and go from being a habitual saver to a smart investor by investing in top performing mutual funds and give your portfolio a boost that it needs. We at Rankmf.com thought about putting together a list of top mutual fund schemes for each category to help you choose the right fund scheme. Each of these schemes has been evaluated taking into consideration a variety of factors and has emerged as top-ranking funds under their respective categories. Read through to know the top featuring mutual funds on RankMF –

Watch this video to understand the basics of mutual funds:

Equity Categories of Top Performing Mutual Funds

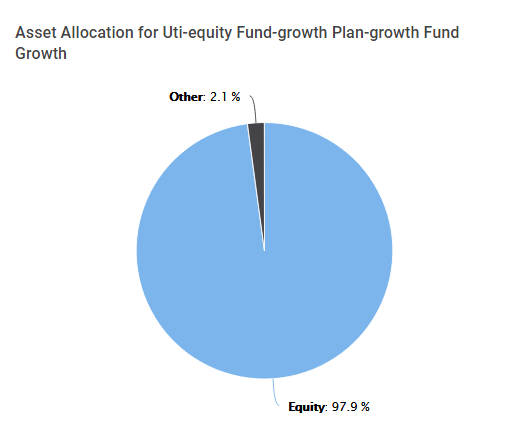

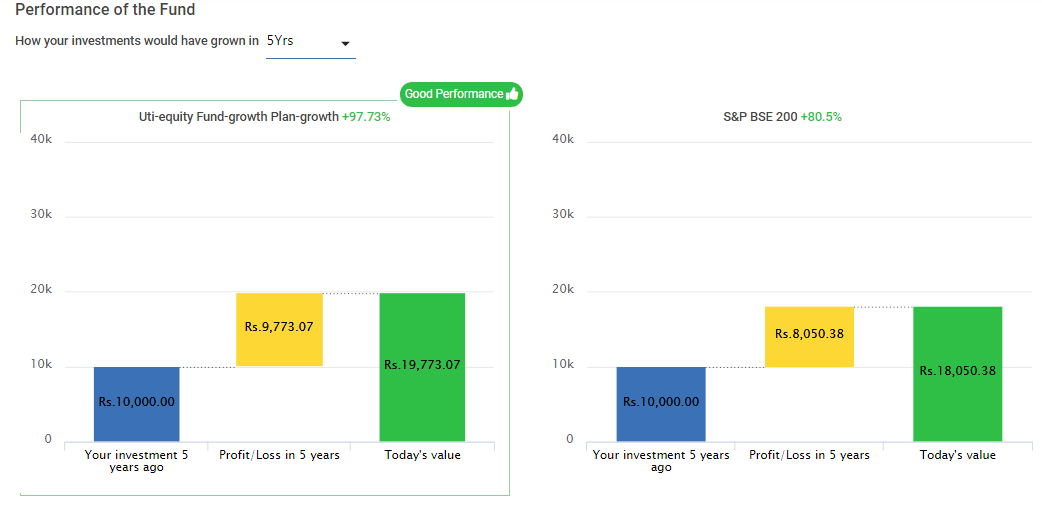

1) Uti-equity Fund-Growth Plan

This, one of the top funds on RankMF, is an open-ended multi-cap fund. Incepted in 2005, these funds invest across all types of market cap stocks. This fund invests majorly in Private Banks, NBFCs, IT, Pharma sector etc. The risk involved in this fund is moderately high and since inception, it has given returns of 14.69%.

Investment objective: The objective of this scheme is to generate long term capital appreciation by investing in equity securities of companies across the market capitalization spectrum.

Category: Multi-cap

Fund Manager: Ajay Tyagi

Key Information:

| RankMF Rank | 1 |

| Inception Date | 1-Aug-05 |

| NAV | 137.37 |

| AUM | Rs. 8649.29 Cr |

| Expense Ratio | 2.23% |

| Exit Load | 1% before 1 year; Nil on or after 1 year |

| Minimum Investment | 5000 |

| Minimum SIP Amount | 500 |

| Returns: | |

| 1 Year (%) | 8.04% |

| 3 Year (%) | 13.68% |

| 5 Year (%) | 14.54% |

Portfolio Holdings:

| Top Holdings: | Asset Allocation: | |

| Securities | Weight (%) |  |

| Bajaj Finance Ltd. | 7.12% | |

| HDFC Bank | 5.56% | |

| Indusind Bank Ltd. | 4.39% | |

| Kotak Mahindra Bank Ltd. | 3.78% | |

| Infosys Ltd. | 3.53% | |

| HDFC Ltd. | 3.36% | |

| TCS Ltd. | 3.16% | |

| Yes Bank Ltd. | 3.07% | |

| Info-Edge (India) Ltd. | 2.91% | |

| Mindtree Ltd. | 2.87% | |

39.75 % of total assets are invested in the stocks below.

Performance of the Fund:

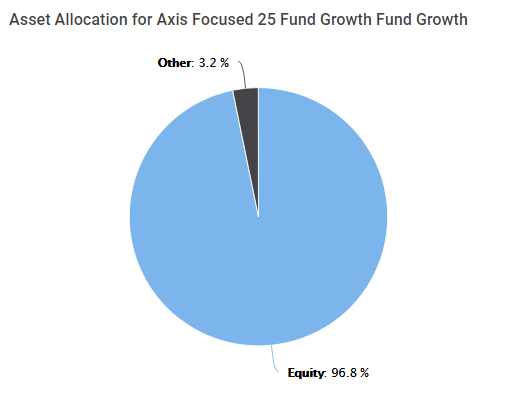

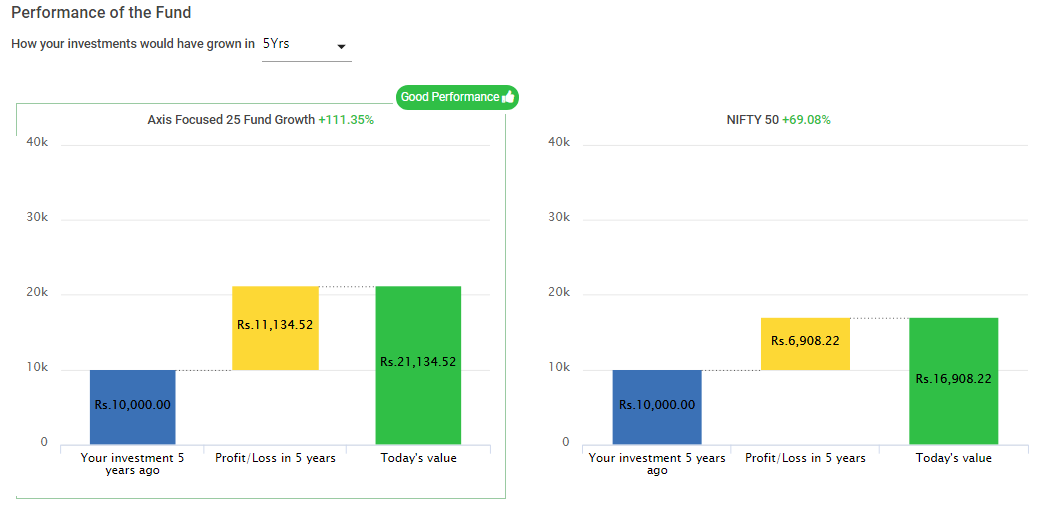

2) Axis Focused 25 Fund Growth

This is a focused fund scheme which holds 23 stocks with major exposure in Finance and IT sector. The risk involved in this fund is moderately high and since inception, it has given returns of 16.36%.

Investment objective: The objective of this scheme is to generate long term capital appreciation by investing in a concentrated portfolio of equity securities of up to 25 companies.

Category: Focused Fund

Fund Manager: Jinesh Gopani

Key Information:

| RankMF Rank | 2 |

| Inception Date | Jun 29, 2012 |

| NAV | 26.08 |

| AUM | Rs. 6761.67 Cr |

| Expense Ratio | 2.2% |

| Exit Load | Nil for 10% of investments and 1% for remaining investments on or before 12 months; Nil after 12 months |

| Minimum Investment | 5000 |

| Minimum SIP Amount | 1000 |

| Returns: | |

| 1 Year (%) | 4.53% |

| 3 Year (%) | 17.35% |

| 5 Year (%) | 16.07% |

Portfolio Holdings:

| Top Holdings: | Asset Allocation: | |||||||||||||||||||||||||||||||||

|

|

67.32 % of total assets are invested in these stocks.

Performance of the Fund:

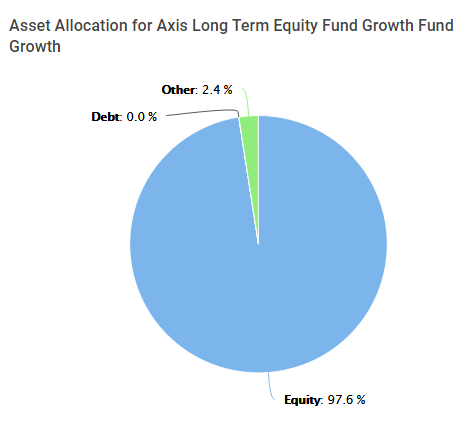

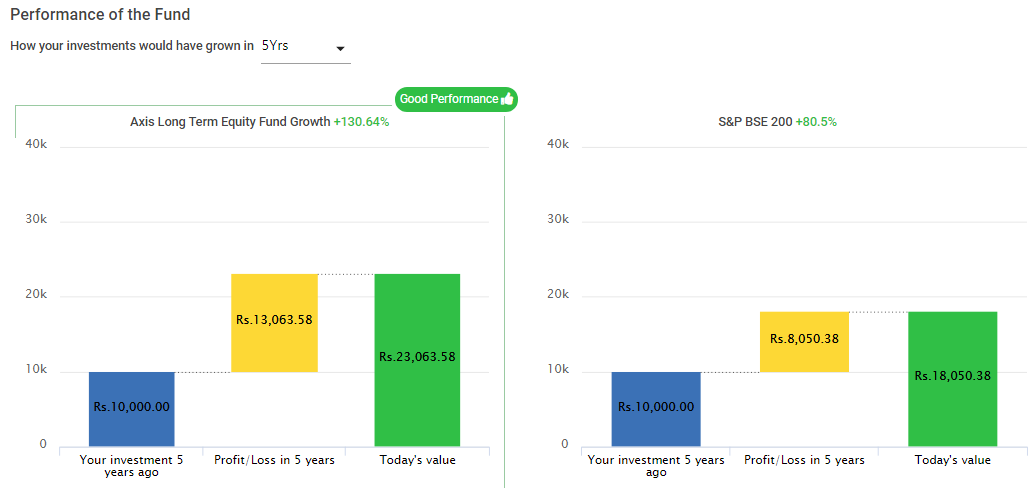

3) Axis Long Term Equity Fund Growth

Incepted in 2009, this is an ELSS fund scheme which comes with a lock-in period of 3 years. These mutual funds maintain portfolio largely in the stocks. This fund invests majorly in Private Banks, NBFCs, IT, Chemicals and Finance sector. The risk involved in this fund is moderately high and since inception, it has given returns of 17.54%.

Investment objective: The objective of this scheme is to generate income and long-term capital appreciation from a diversified portfolio of predominantly equity securities.

Category: ELSS

Fund Manager:Jinesh Gopani

Key Information:

| RankMF Rank | 3 |

| Inception Date | Dec 28, 2009 |

| NAV | 42.25 |

| AUM | Rs. 17425.59 Cr |

| Expense Ratio | 1.88% |

| Exit Load | Nil |

| Minimum Investment | 500 |

| Minimum SIP Amount | 500 |

| Returns: | |

| 1 Year (%) | 5.32% |

| 3 Year (%) | 14.12% |

| 5 Year (%) | 18.24% |

Portfolio Holdings:

| Top Holdings: | Asset Allocation: | |||||||||||||||||||||||||||||||||

|

|

63.13 % of total assets are invested in the top holdings.

Performance of the Fund:

Debt Category

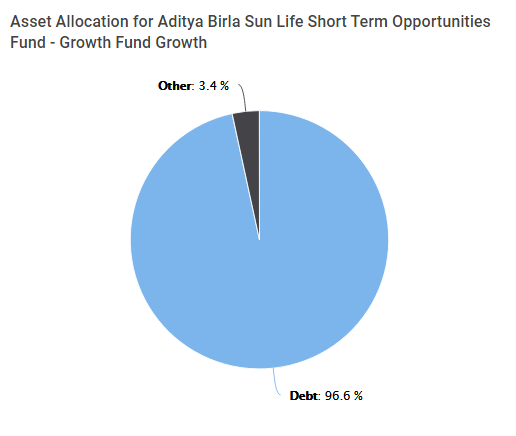

4) Aditya Birla Sun Life Short Term Opportunities Fund – Growth:

Launched in 2003, this fund invests in debt securities such that the average maturity (remaining) period for the portfolio is between 1 to 3 years. It is suitable if you have a short-term investment horizon and are looking for funds with lower risk. This fund is moderately risky and since inception, it has given 7.33% returns.

Investment objective: The objective of this scheme is to generate income and capital appreciation by investing 100% of the corpus in a diversified portfolio of debt and money market securities.

Category: Short Duration Fund

Fund Manager: Maneesh Dangi, Kaustubh Gupta

Key Information:

| RankMF Rank | 1 |

| Inception Date | May 05, 2003 |

| NAV | 30.65 |

| AUM | Rs. 3556.79 Cr |

| Expense Ratio | 1.13% |

| Exit Load | Nil upto 15% of units; 0.50% in excess of limit on or before 90 days and Nil after 90 days |

| Minimum Investment | 1000 |

| Minimum SIP Amount | 1000 |

| Returns: | |

| 1 Year (%) | 7.08% |

| 3 Year (%) | 7.77% |

| 5 Year (%) | 8.52% |

Portfolio Holdings:

| Top Holdings: | Asset Allocation: | |||||||||||||||||||||||||||||||||

|

|

38.85% of total assets invested in the securities below.

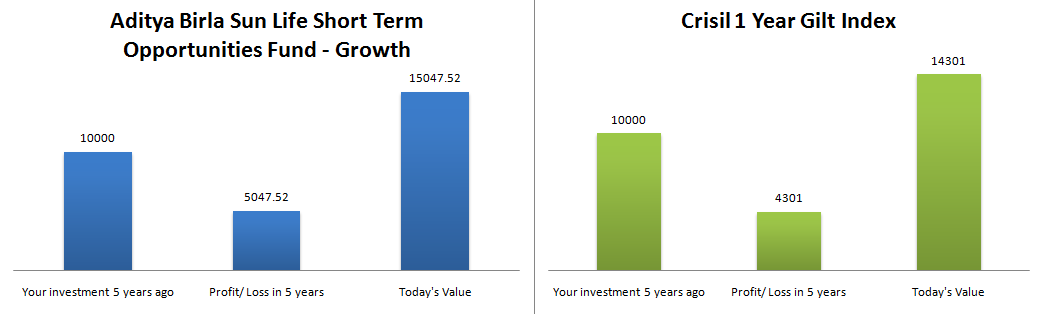

Performance of the Fund:

How Investments have grown in 5 years?

Aditya Birla Sun Life Short Term Fund gives you 50.48% returns in 5 years and performs better in comparison to Crisil 1 Year Gilt Index which gives you 43.01% returns on an investment of Rs. 10,000.

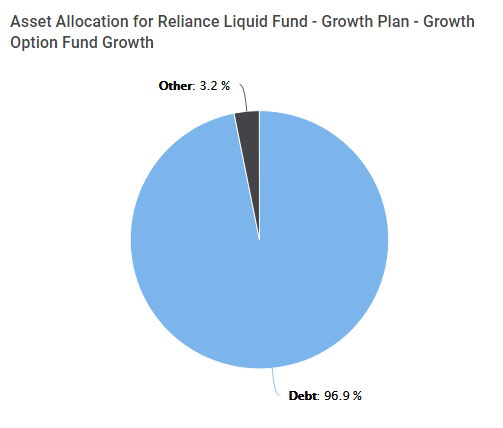

5) Reliance Liquid Fund – Growth Plan

This is a liquid fund which invests a major portion of the fund’s assets in debt securities and money market instruments. You can invest in this fund if you want to park your surplus cash balances and earn better returns than what you would earn on a savings account. This fund has very low risk involved and it has given returns of 7.40% since inception.

Investment objective: The objective of this scheme is to generate optimal returns consistent with moderate levels of risk and high liquidity by investing in debt and money market instruments.

Category: Debt – Liquid Fund

Fund Manager: Anju Chhajer, Kinjal Desai

Key Information:

| RankMF Rank | 1 |

| Inception Date | Dec 08, 2003 |

| NAV | 4519.1412 |

| AUM | Rs. 41188.08 Cr |

| Expense Ratio | 0.23% |

| Exit Load | Nil |

| Minimum Investment | 100 |

| Minimum SIP Amount | 500 |

| Returns: | |

| 1 Year (%) | 7.54% |

| 3 Year (%) | 7.22% |

| 5 Year (%) | 7.77% |

Portfolio holdings:

| Top Holdings: | Asset Allocation: | |||||||||||||||||||||||||||||||||

|

|

23.39% of total assets invested in the top holdings.

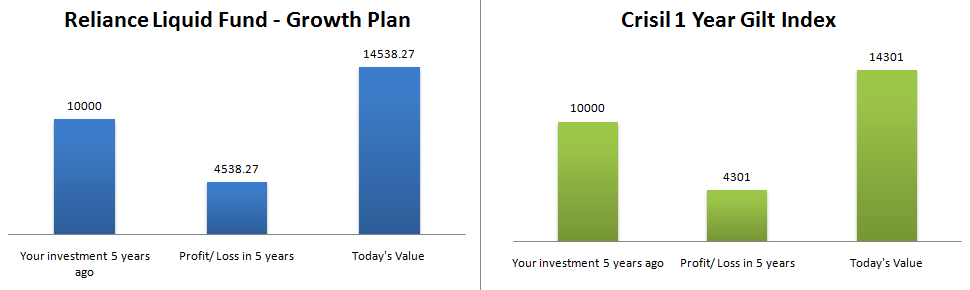

Performance of the Fund:

How Investments have grown in 5 years?

Reliance Liquid Fund gives better returns of 45.38% over the period of 5 years and performs better in comparison to Crisil 1 Year Gilt Index which gives you 43.01% returns on an investment of Rs. 10,000.

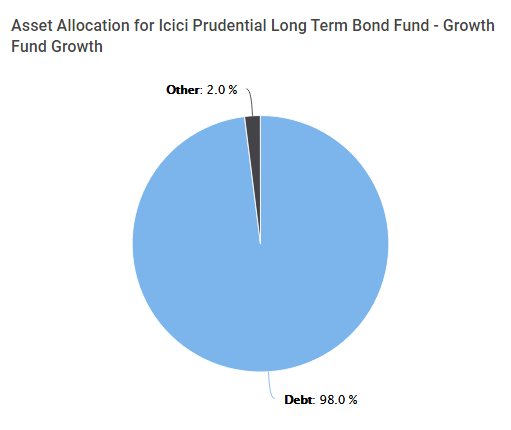

6) Icici Prudential Long Term Bond Fund – Growth

This is a long duration fund scheme which was launched in1998. These portfolios are core fixed income portfolios with durations longer than six years. It is ideal for you if you are a risk-averse investor who wishes to maximize returns and at the same time preserve capital. The risk involved in this fund is moderate and since inception, it has given returns of 8.94%.

Investment objective: The objective of this scheme is to generate income through investments in a range of debt and money market instruments while maintaining the optimum balance of yield safety and liquidity.

Category: Long Duration Fund

Fund Manager: Manish Banthia

Key Information:

| RankMF Rank | 1 |

| Inception Date | July 6, 1998 |

| NAV | 58 |

| AUM | Rs. 710.04 Cr |

| Expense Ratio | 1.48% |

| Exit Load | Nil |

| Minimum Investment | 5000 |

| Minimum SIP Amount | 1000 |

| Returns: | |

| 1 Year (%) | 7.80% |

| 3 Year (%) | 8.77% |

| 5 Year (%) | 9.36% |

Portfolio Holdings:

| Top Holdings: | Asset Allocation: | |||||||||||||||||||||||||||||||||

|

|

100.00 % of the total assets invested in top holdings.

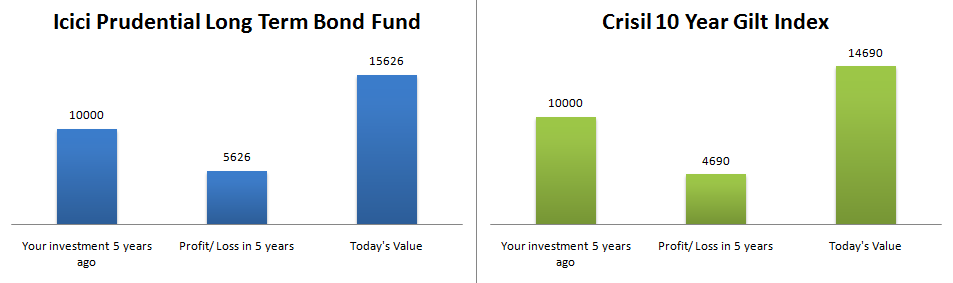

Performance of the Fund:

Icici Prudential Long Term Bond Fund gives better returns than its benchmark index which is shown in the graph above. Assuming an investment of Rs. 10,000 at the start of 5 years, the fund gives you 56.26% returns whereas Crisil10 Year Gilt Index gives you 46.90% returns.

Hybrid Category

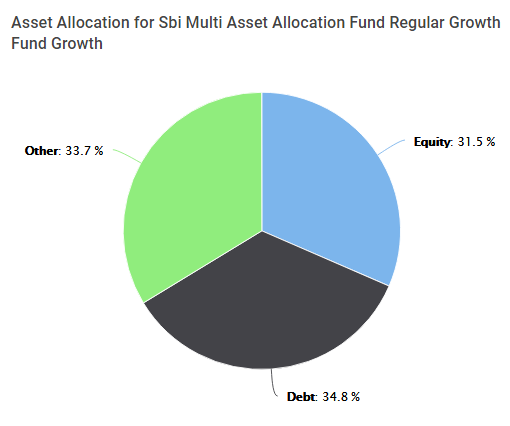

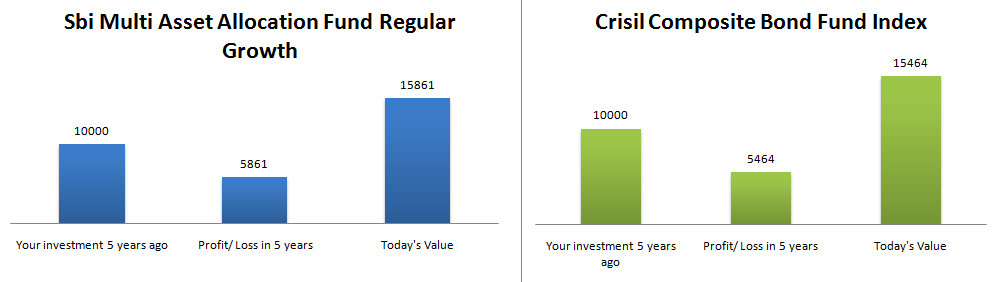

7) Sbi Multi Asset Allocation Fund Regular Growth

This fund was launched in 2005. It is a multi-asset fund aiming to build a diversified portfolio by investing across different asset classes such as equities, debt and gold. If you are looking for portfolio diversification, then multi-asset fund is the solution. The fund is moderately risky and it has given returns of 7.58% from the date of inception.

Investment objective: The objective of this scheme is to provide the investors an opportunity to invest in an inactively managed portfolio of multiple asset classes.

Category: Hybrid – Multi-Asset Allocation

Fund Manager: Ruchit Mehta

Key Information:

| RankMF Rank | 1 |

| Inception Date | Nov 28, 2005 |

| NAV | 26.64 |

| AUM | Rs. 293.83 Cr |

| Expense Ratio | 1.79% |

| Exit Load | Nil for 10% of investment and 1% for remaining investment on or before 12 months; Nil after 12 months |

| Minimum Investment | 5000 |

| Minimum SIP Amount | 500 |

| Returns: | |

| 1 Year (%) | 3.49% |

| 3 Year (%) | 7.41% |

| 5 Year (%) | 9.62% |

Portfolio Holdings:

| Top Holdings: | Asset Allocation: | |||||||||||||||||||||||||||||||||

|

|

74.69% of total assets are invested in the top holdings.

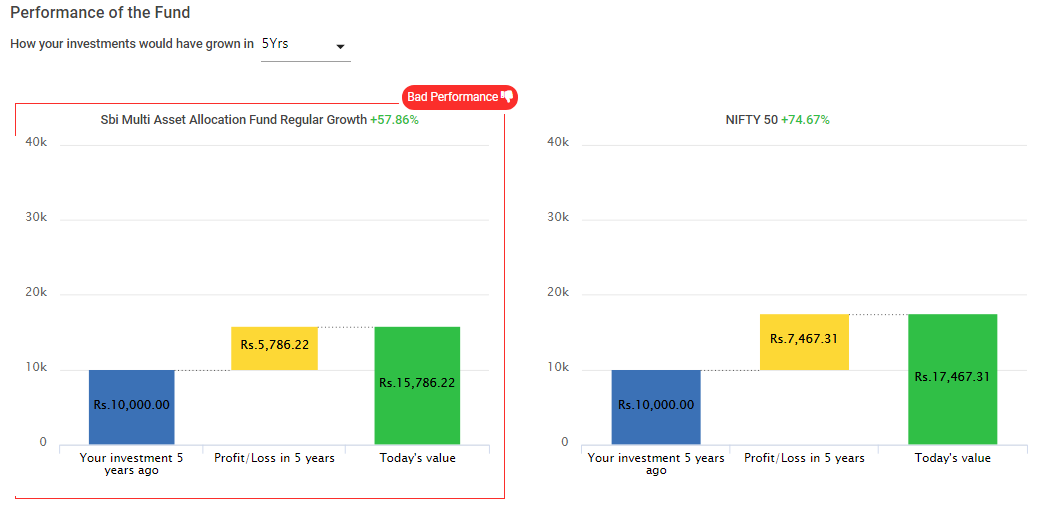

Performance of the Fund:

Nifty 50 has given 73.41% returns in 5 years on an initial investment amount of Rs. 10,000. In comparison to that this scheme has underperformed the benchmark and given returns of 58.62%.

Sbi Multi Asset Allocation Fund gives better returns of 58.61% over the period of 5 years and performs better in comparison to Crisil Composite Bond Fund Index which gives you 54.64% returns on an investment of Rs. 10,000.

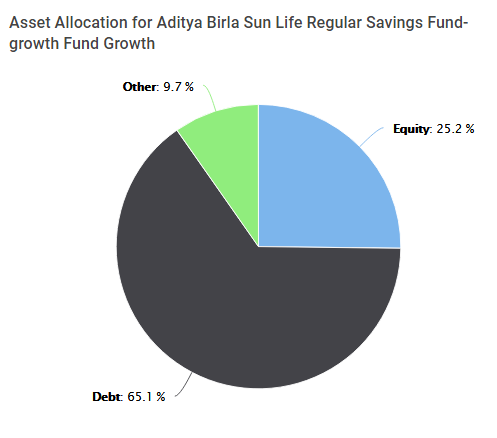

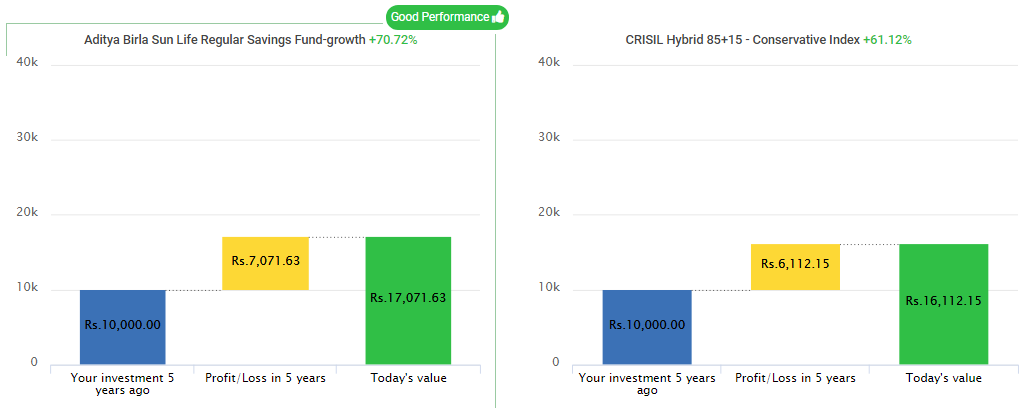

8) Aditya Birla Sun Life Regular Savings Fund – Growth

This is a conservative hybrid scheme which invests a major portion of the fund’s assets in debt securities. You can invest in this fund if you want a small exposure to equity to earn extra returns but don’t have the risk appetite to invest in pure equity mutual funds. The risk involved in this fund is moderately high and it has given returns of 9.61% from the date of inception.

Investment objective: The objective of this scheme is to generate regular income through investment in fixed income securities so as to make monthly payment or distributions to unitholders with the secondary objective being growth.

Category: Conservative Hybrid Fund

Fund Manager: Satyabrata Mohanty, Pranay Sinha

Key Information:

| RankMF Rank | 1 |

| Inception Date | May 17, 2004 |

| NAV | 38.63 |

| AUM | Rs. 2315.56 Cr |

| Expense Ratio | 1.81% |

| Exit Load | Nil upto 15% of units; 1% in excess of limit on or before 1 year and Nil after 1 year |

| Minimum Investment | 500 |

| Minimum SIP Amount | 500 |

| Returns: | |

| 1 Year (%) | 1.89% |

| 3 Year (%) | 9.68% |

| 5 Year (%) | 11.26% |

Portfolio Holdings:

| Top Holdings: | Asset Allocation: | |||||||||||||||||||||||||||||||||

|

|

39.70% of total assets are invested in the top holdings.

Performance of the Fund:

Aditya Birla Sun Life Regular Savings Fund has given 70.72% returns in 5 years on an initial investment amount of Rs. 10,000. It has outperformed its benchmark – Crisil Hybrid 85+15 Conservative Index which has given returns of 61.12% for the specified period.

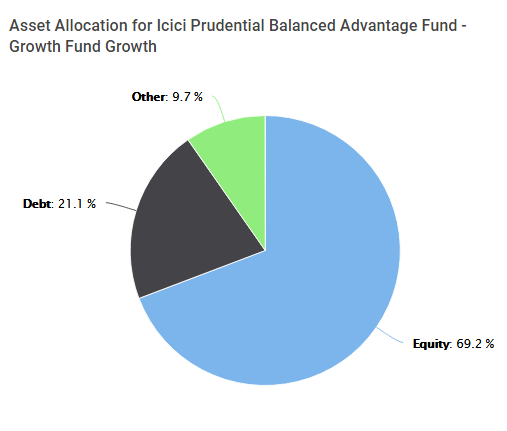

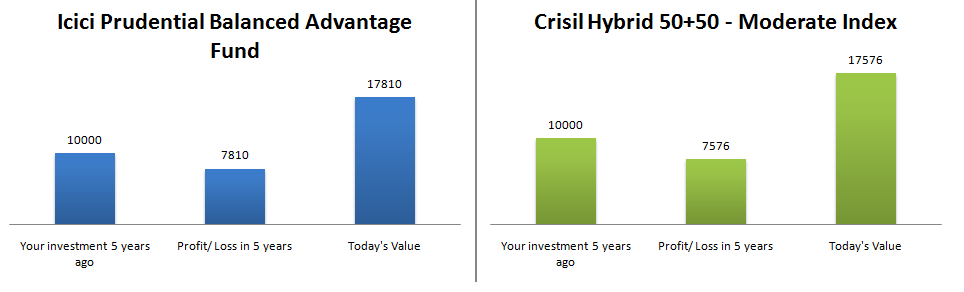

9) Icici Prudential Balanced Advantage Fund – Growth

Incepted in 2006, this is a balanced fund scheme which is a mix of Debt and Equity mutual funds. It invests a major portion of the fund’s assets in equity securities with top holdings in the Private Bank and IT sector. The risk involved in this fund is moderately high and since inception, it has given returns of 10.83%.

Investment objective: The objective of this scheme is to provide capital appreciation and income distribution to the investors by using equity derivatives strategies arbitrage opportunities and pure equity investments.

Category: Hybrid – Balanced Advantage Fund

Fund Manager: Sankaran Naren, Manish Banthia

Key Information:

| RankMF Rank | 2 |

| Inception Date | Dec 25, 2006 |

| NAV | 34.8 |

| AUM | Rs. 28498.56 Cr |

| Expense Ratio | 1.99% |

| Exit Load | Nil on 15% of units within 18 months and 1% for more than 15% of units within 18 months; Nil after 18 months |

| Minimum Investment | 500 |

| Minimum SIP Amount | 100 |

| Returns: | |

| 1 Year (%) | 5.52% |

| 3 Year (%) | 11.88% |

| 5 Year (%) | 12.19% |

Portfolio Holdings:

| Top Holdings: | Asset Allocation: | |||||||||||||||||||||||||||||||||

|

|

50.58% of total assets are invested in the top holdings.

Performance of the Fund:

Icici Prudential Balanced Advantage Fund has given 78.10% returns in 5 years on an initial investment of Rs. 10,000, outperforming its benchmark – Crisil Hybrid 50+50Moderate Index which has given returns of 75.76% for the specified period.

Note:

1) All the above funds are open-ended funds and growth options.

2) All the above data has been taken from RankMF.com as on 13/03/2019. Returns calculated from Crisil Indices have been taken from the Crisil website.

This covers the vast subject of top performing mutual funds. For more useful articles on Mutual Funds, trading, investing and market knowledge, visit our Investor Education section.

(Note: This content is for information purpose only. Avoid trading and investing based on the information given above. Before investing in stocks or mutual funds, please conduct proper due diligence. Mutual Fund scheme rankings mentioned above are subject to change based on the changing market scenario)

Tell about Canara Robeco MF

Hi Sir, You can get information on all the mutual funds from our platform. Please visit https://www.rankmf.com

I shall be happy to have your advise regarding mutual fund advises as per my requirement . I shall be happy is some one from your end contact me for personal discussion ,so that I can understand and plan my investment accordingly..

Hi Sir, please share your contact details at mobileapps@samco.in. Our executives will get in touch with you to understand your query and guide you properly

Thank you for bringing such topic into light, I really loved the concept of your article. Thanks for sharing this information. It’s a great source of knowledge; I think it will be helpful for lot of people who are looking for learning more about top performing mutual funds.

Hi Sir, Thank you for those kind words. We are glad you liked the blog. Stay tuned for more informative blogs like these. Please visit our platform https://www.rankmf.com for more information or follow us on our social media handles to get latest updates.