A large cap mutual fund is an equity-oriented fund. It invests a major portion of its corpus in stocks of large cap companies like Reliance Industries Ltd., HDFC Ltd, Infosys Ltd., State Bank of India etc. These companies are market leaders and have stable cash flows. Hence, large cap funds experience low volatility. This is primarily why large cap mutual funds are considered to be the safest type of equity funds in India.

In today’s article, we will understand what are large cap mutual funds. We will also reveal the list of the best large cap mutual funds in 2021.

List of 5 Best Large Cap Mutual Funds in 2021

| 5 Best Large Cap Mutual Funds in 2021 | 1 Year | 3 Years | 5 Years | AUM (In Crores) | Expense Ratios (%) |

| DSP Top 100 Equity Fund | 44.69% | 10.28% | 10.82% | 2,795 | 2.09% |

| Axis Bluechip Fund | 40.66% | 14.11% | 15.96% | 28,247 | 1.76% |

| Kotak Bluechip Fund | 46.60% | 14.13% | 13.28% | 2,804 | 2.10% |

| UTI Mastershare Unit Scheme | 48.55% | 13.37% | 13.39% | 8,427 | 2.05% |

| Canara Robeco Bluechip Equity Fund | 44.24% | 16.13% | 15.88% | 3,308 | 1.96% |

As of August 2021 **Data source: www.rankmf.com

What is Large Cap Mutual Funds?

As per Securities and Exchange Board of India (SEBI), large cap mutual funds must invest minimum 80% of their corpus in equity shares of large cap companies. These are the top 100 companies listed on the exchange on the basis of market capitalisation.

So, basically all the stocks listed in S&P BSE Sensex, Nifty 50 and Nifty 100 are large cap stocks. These companies generally enjoy high brand value, customer loyalty, financial stability and have huge cash reserves. All of these things help them tide through economic downturns. This is one of the reasons why large cap stocks have limited downside during a market crash.

Large cap mutual funds are also known as blue chip mutual funds. The name is derived from the game of poker where blue coloured chips had the highest value. So, basically large cap mutual funds invest in most valued companies of India. This makes them more resilient and store of value during market crashes.

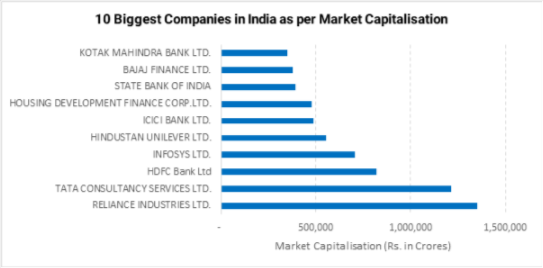

The below chart shows the top 10 large cap stocks in India (as per market capitalisation). These stocks feature in majority of the portfolios of large cap mutual funds.

*Data as of August 2021 **nseindia

What are the Advantages of Large Cap Mutual Funds? – Why Should You Invest in Large Cap Mutual Funds?

1. Stable Returns: The biggest advantage of large cap mutual funds is that they offer stable and consistent returns. This is because their underlying stocks are reputed companies with established products and services which remain in demand even during economic slowdowns. This helps them earn consistent revenue.

This is unlike midcap and small cap funds which experience high fluctuations since these companies are mostly start-ups with little brand presence and inconsistent cashflows.

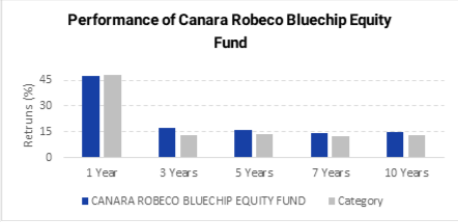

The below chart shows the return generated by Canara Robeco Bluechip Equity Fund – one of the best large cap mutual funds for 2021. Note the consistency of its returns.

*Data as of August 2021 **Source: www.rankmf.com

The fund has consistently outperformed its benchmark across all time periods. So, if you are looking for consistent returns then you must invest in large cap mutual funds.

2. Regular Dividend Income: This advantage of large cap mutual funds is very useful for retirees and senior citizens. Large cap companies have huge cash reserves. This helps them declare regular dividends to reward their shareholders. Unitholders of large cap funds have two options –

- If they choose growth option, then the dividend is reinvested back into the fund.

- But if they want to enjoy cash dividends, then they can choose dividend payout option.

The below table shows the dividends paid by Mirae Asset Large Cap Fund – one of the best large cap mutual funds in 2021.

| Record Date | Dividend Per Unit |

| 23-03-21 | 1.65 |

| 16-12-19 | 1.33 |

| 06-12-18 | 1.42 |

| 12-03-18 | 2.00 |

| 24-07-17 | 1.70 |

| 26-07-16 | 1.50 |

| 11-03-16 | 1.35 |

| 13-02-15 | 1.60 |

| 27-01-14 | 1.20 |

| 14-03-13 | 1.40 |

| 22-03-12 | 1.50 |

| 10-12-10 | 1.50 |

| 09-09-09 | 0.90 |

*Data as of August 2021 **Source: www.rankmf.com

The fund has consistently declared dividends every year (except 2020) since its inception. Additionally, there has been a consistent increase in the dividend paid per unit.

Such stable dividend income is rare in case of mid and small cap funds. This is because these companies have limited cash reserves and are unable to pay dividends if the company is in loss or if the economy is bad.

So, if you want regular dividend income then large cap mutual funds are ideal for you.

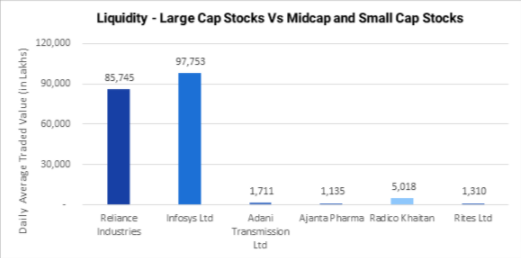

3. High Liquidity: Any good investment option must have high liquidity. This is also true in the case of large cap mutual funds. In a mutual fund, the fund manager actually buys and sells shares on behalf of the unitholders. The quantity of these shares is in lakhs.

Now imagine that the fund manager wants to sell his stake in a particular stock. But there are no buyers! This is known as liquidity risk. This usually happens in the case of midcap and small cap funds. Since these stocks are not well known, very few investors trade in them. But large cap stocks belong to the top 100 companies. These companies enjoy very high trading volumes and liquidity.

The below chart shows the daily trading volume of large cap stocks vs mid and small cap stocks.

*Data as of August 2021 **Source: nseindia

Now tell me… where will you be able to close your position quickly? In Infosys Ltd or Adani Transmission Ltd?

This is why large cap mutual funds are so great. Your fund manager can liquidate or book profits easily. Hence, liquidity is one of the biggest advantages of large cap funds.

4. Low Risk Due to Perpetual Demand: Large cap funds carry very little risk. This is because large cap companies fall in the too-big-to-fail category. We are talking about market leaders, companies with millions in cash reserves and whose products are always in demand.

Can you imagine the banking sector without the State Bank of India? Or the Fast Moving Consumer Goods (FMCG) sector without Hindustan Unilever Ltd? It simply not possible.

The goods and services manufactured by large cap companies will be in demand perpetually. This means, these companies will have a steady cash flow even when the economy is in turmoil. This is why large cap stocks and funds carry very little risk of failure or default.

5. Access to biggest companies with low investment: The current market price of one share of Reliance Industries is Rs 2,089. So, can you buy this one share with Rs 500? Individually you cannot but with large cap funds, you can. By pooling funds from lakhs of investors, you are able to take exposure to Reliance Industries with just Rs 500. So, affordability is one of the key advantages of large cap funds.

What are the Disadvantages of Large Cap Funds?

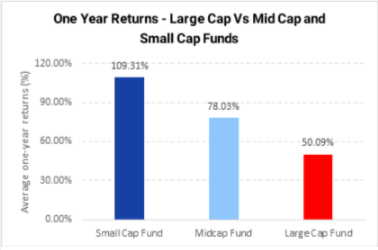

Large cap funds provide stable and consistent returns. But there is a flip side to this. The biggest disadvantage of large cap funds is that they underperform mid and small cap funds in a bull market.

The below table shows the returns generated by large cap funds vs mid and small cap funds in the last one year.

*Data as of August 2021 **Source: www.rankmf.com

As you can see, large cap funds have gravely underperformed small and mid-cap funds in last one year as markets went up. This is a price that investors have to pay for low-risk returns.

How are Large Cap Funds Taxed? – Large Cap Mutual Fund Taxation

Large cap funds invest 80% of their corpus in equity shares. Hence, they follow equity taxation. The holding period for large cap funds is 12 months.

- If you sell before 12 months, you incur short term capital gains (STCG). STCG tax on large cap mutual funds is flat 15%.

- If you sell after 12 months, you incur long term capital gains (LTCG). LTCG tax on large cap funds is 10% but only if your gains exceed Rs 1 Lakh in a financial year.

- If you sell after 12 months but your LTCG is below Rs 1 Lakh then you do not have to pay any tax.

Note: The Rs 1 lakh exemption limit also includes gains on equity shares.

Let us take a closer look at the five best large cap mutual funds in 2021.

5 Best Large Cap Mutual Funds in 2021

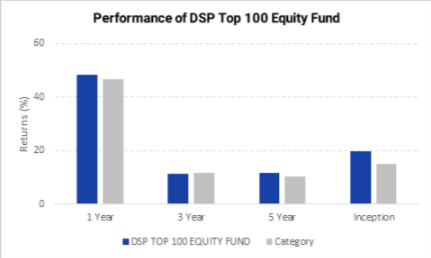

1. DSP Top 100 Equity Fund is truly one of the best large cap mutual funds in 2021. The fund has generated a return of 44.69% in the last one year. However, the fund has a relatively low AUM of Rs 2,795 crores only.

The fund holds 27 stocks in its portfolio. It invests 25.38% of its corpus in financial stocks like ICICI Bank (9.31%), HDFC Bank (8.35%) etc. The fund also invests 12.78% of its corpus in mid cap stocks which is higher than category average of 9.10%. This makes the fund very risky and suitable for aggressive investors only.

The fund follows a growth strategy as evident by its portfolio price to earnings (PE) ratio of 31.72 and price to book value (PB) ratio of 4.76.

The below chart shows the performance of DSP Top 100 Equity Fund against its benchmark S&P BSE 100 TRI.

*Data as of August 2021 **Source: www.rankmf.com

The fund has beaten its benchmark across short-term and long-term. You can start a systematic investment plan (SIP) in DSP Top 100 Equity Fund, one of the best large cap mutual funds with just Rs 500. The fund has a lock-in period of 12 months. If you redeem before the exit load period, you will have to pay a penalty of 1%.

Since the fund has above average exposure to mid cap sector, it is suitable for high risk investors only.

2. Axis Bluechip Fund is one of the most popular and best large cap mutual fund in 2021. It has generated a return of 40.66% in the last one year. The fund has consistently outperformed its benchmark, S&P BSE 100 TRI.

*Data as of August 2021 **Source: www.rankmf.com

The fund has a massive AUM of Rs 28,247 crores. This is 406% higher than other schemes in the large cap category. So, its safe to say that Axis Bluechip Fund is a favourite among investors.

As a plus point, the fund’s expense ratio is 1.76% only. This is 47% lower than average of the large cap category. The fund is also a growth-oriented fund with a PE ratio of 38.61 and PB ratio of 5.22.

Portfolio Structure of Axis Bluechip Fund

| Market Capitalisation | Fund | Category |

| Large (%) | 98.95 | 92.89 |

| Mid (%) | 1.05 | 9.1 |

| Small (%) | — | 2.17 |

*Data as of August 2021 **Source: www.rankmf.com

Compared to its peers (67.47%), the fund has higher allocation to giant blue-chip companies (87.03%). This makes it less risky. The fund has only 1.05% allocation to mid cap stocks and zero allocation to small cap stocks. This makes it a perfect large cap fund for conservative investors.

Axis Bluechip Fund is heavily invested in financials (36.89%) and Information & Technology (18.41%) stocks. It’s top five holdings include:

| Company | Sector | Allocation (%) |

| Infosys Ltd | Technology | 9.79 |

| HDFC Bank Ltd. | Financial | 8.9 |

| Bajaj Finance Ltd. | Financial | 8.67 |

| ICICI Bank Ltd | Financial | 7.37 |

| Tata Consultancy Services Ltd | Technology | 7.19 |

*Data as of August 2021 **Source: www.rankmf.com

The fund has managed to deliver superior returns while taking low risk. Hence, Axis Bluechip Fund is one of the best large cap funds in 2021. You can start a SIP in Axis Bluechip Fund with just Rs 500 per month.

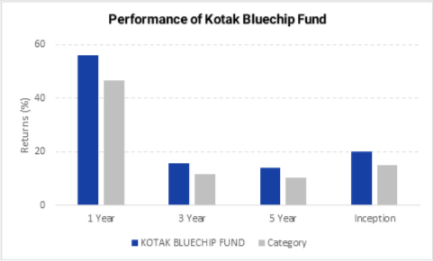

3. Kotak Bluechip Fund is one of the less popular but still one of the best large cap mutual funds in 2021. The fund has generated a one-year return of 46.60%. It has managed to consistently beat its benchmark by a decent margin.

*Data as of August 2021 **Source: www.rankmf.com

The fund has an AUM of Rs 2,804 crores only. Despite this, it has invested as high as 18.60% in mid cap stocks. This is double the exposure of the category average of 9.10%.

| Market Capitalisation | Fund | Category |

| Large (%) | 80.88 | 92.89 |

| Mid (%) | 18.6 | 9.1 |

| Small (%) | 0.52 | 2.17 |

| Tiny (%) | — | – |

*Data as of August 2021 **Source: www.rankmf.com

Hence, the fund is suitable for high risk investors only with a long-term time horizon. The fund also has a high expense ratio of 2.10%. So, Kotak Bluechip Fund is one of the best large cap mutual funds for aggressive investors.

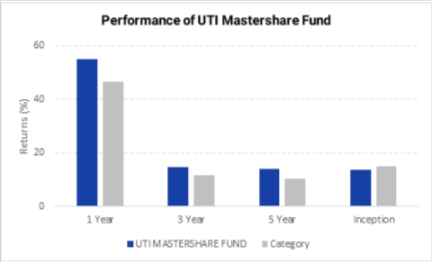

4. UTI Mastershare Fund is the fourth best large cap mutual fund in 2021. The fund has given a return of 48.55% in the last one year. This is even better than Axis Bluechip Funds return of 40.66%. As expected, the fund has beaten its benchmark across all time frames.

*Data as of August 2021 **Source: www.rankmf.com

UTI Mastershare Fund invests heavily in financial sector (28.78%), IT (16%) and healthcare (10.07%) sector.

But like Kotak Bluechip Fund, even UTI Mastershare fund has an above average exposure to midcap stocks (12.1%). Hence, it is suitable for aggressive investors only with a long-term investment horizon.

| Market Capitalisation | Fund | Category |

| Large (%) | 86.94 | 92.89 |

| Mid (%) | 12.1 | 9.1 |

| Small (%) | 0.96 | 2.17 |

*Data as of August 2021 **Source: www.rankmf.com

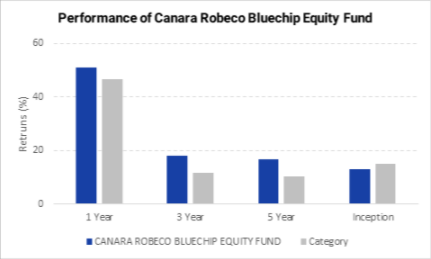

5. Canara Robeco Bluechip Equity fund comes in fifth on our list of the five best large cap mutual funds in 2021. The fund has generated a return of 44.24% in the last one year.

*Data as of August 2021 **Source: www.rankmf.com

The fund invests 74.31% in giant companies like HDFC Bank, Infosys etc. Another 15.70% is invested in large cap stocks while 9.99% is invested in midcap stocks. This allocation is in line with the category average. The fund is bullish on financial sector as it invests one third of the corpus in financial stocks.

The fund is being managed by Shridatta Bhandwaldar and Mr. Mishra. It was launched in August 2010 and has an AUM of Rs 3,308 crores. It has an expense ratio of 1.96%. Since the fund carries high risk, it is suitable for moderately aggressive investors with medium term (5-7 years) time horizon.

How to Invest in the Best Large Cap Mutual Funds in India?

You can invest in best large cap mutual funds in 2021 in less than 15 minutes with RankMF. To invest in the best large cap funds, follow the below steps:

- Use you Samco Demat account credentials to login to RankMF. If you don’t have a Samco Demat account yet then open a FREE Demat account in less than 15 minutes!

- When you open a Samco Demat account you get FREE access to RankMF, KyaTrade and StockNote.

- Complete your Know your Customer (KYC) formalities. This will take you less than 10 minutes.

- Shortlist the fund you want to invest in.

- Register SIP or make lumpsum investments in your favourite large cap fund and you’re done!

FAQs on Best Large Cap Mutual Funds

1.What is a mutual fund?

A Mutual fund is an investment vehicle which collects money from lakhs of investors. This money is then used to buy stocks, debt instruments or gold. It is managed by a fund manager on behalf of the investors. Watch this video to learn everything about mutual funds.

2.What are large cap mutual funds?

A large cap mutual fund invests in stocks of large cap companies. These are the top 100 companies listed on the exchange. They are well established, reputed, financially stable and experience less volatility. Hence, large cap funds are perfect for conservative investors.

3.Are large cap mutual funds safe?

Large cap mutual funds invest in too-big-to-fail types of companies like Reliance Industries, Infosys, State Bank of India etc. But that does not mean that large cap funds are safe. They face market risks and are riskier compared to debt funds. So, large cap funds are not 100% safe.

4.Which is the best large cap mutual funds in 2021?

The five best large cap mutual funds in 2021 are:

- DSP Top 100 Equity Fund

- Axis Bluechip Fund

- Kotak Bluechip Fund

- UTI Mastershare Unit Scheme

- Canara Robeco Bluechip Equity Fund

5.What are the advantages of large cap mutual funds?

The biggest advantage of large cap funds is that they offer you stable returns as they invest in the biggest companies of India. They also limit the downside risk in a falling market. Large cap funds offer consistent dividends and have high liquidity.

6.What are the risks of large cap mutual funds?

The biggest risk in large cap mutual funds is the lack of diversification. Large cap funds have to invest 80% of their corpus in top 100 companies. Since the mandate is same for all large cap funds, the chances of outperforming their peers is slim. Since they invest in established companies, they are unable to benefit from the growth spurt of mid and small cap stocks.

Leave A Comment?