As the name suggests, short term debt funds invest in ‘short duration’ debt instruments. These instruments mature between one year to three years. Because of such near-term maturity, short term debt funds are less sensitive to interest rate changes.

Generally, short term debt funds are more in demand when interest rates are rising. This is why they have generated below average return in the last one year. But this isn’t the end for short term debt funds.

Interest rates in India are at multi-year lows. The Reserve Bank of India (RBI) has not changed the repo and reverse repo rate since May 2020. But that was due to economic slowdown because of the Covid19 pandemic. But as the economy stabilizes, there is a possibility that interest rates will increase.

If interest rates start moving upwards, then short term debt funds will benefit the most. But before you shift your entire allocation to short term debt funds, let us first understand what are short term debt Mutual funds and how they work.

Here’s a list of the five best short term debt funds in 2021.

| Best Short Term Debt Funds | 1-Year | 3-Years | 5-Years | Since Inception |

| Aditya Birla SL Short Term Fund | 6.22% | 8.50% | 7.62% | 7.48% |

| Kotak Bond Short Term Fund | 4.36% | 8.14% | 7.32% | 7.68% |

| Nippon India Short Term Fund | 5.69% | 8.17% | 7.29% | 7.96% |

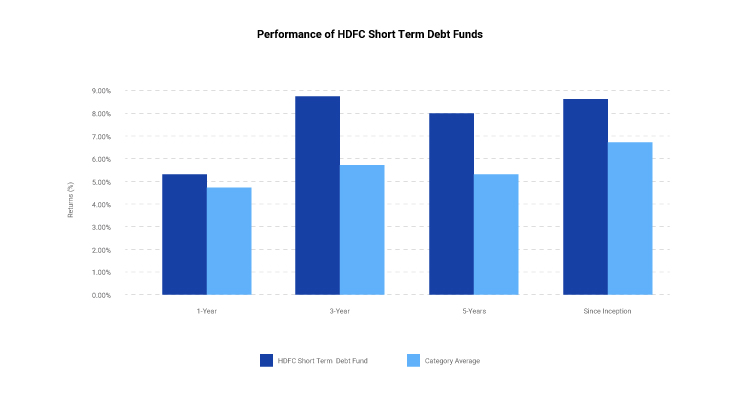

| HDFC Short Term Debt Fund | 5.43% | 8.73% | 7.98% | 8.63% |

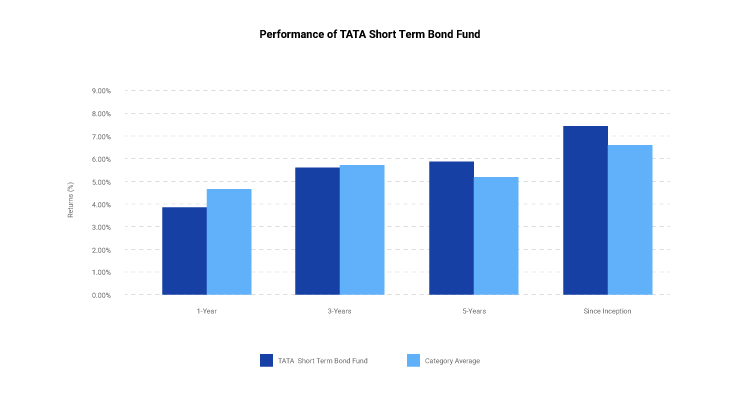

| TATA Short Term Bond Fund | 3.84% | 5.65% | 5.79% | 7.36% |

*Returns as on 12th August 2021 **Data Source: www.rankmf.com

What are Short Term Debt Funds?

A short term debt fund is also known as short duration or income fund. As per Securities & Exchange Board of India (SEBI), a short term debt fund invests in debt and money market instruments with weighted Macaulay Duration of one year to three years.

So, basically a short term debt fund collects funds from various investors. This pool of money is then invested in a mix of debt and money market instruments.

Debt instruments include: Bonds, Debentures, Zero Coupon Bonds, State & Central Government Loans, Government Securities etc.

Money market instruments include: Treasury Bills, Certificate of Deposits, Commercial Papers, etc.

This sounds like any other debt fund, doesn’t it? But wait there is a catch. The fund manager must ensure that the portfolio’s Macaulay duration stays between one to three years.

Watch our video to learn about debt funds

What exactly is a Macaulay Duration? Let’s find out.

What is Macaulay Duration in Short Term Debt Funds?

When an investor invests in a bond, he receives coupon or interest payments. This is his income from the bond. The time period over which a bond investor gets paid back (via coupon) is known as duration. Macaulay Duration is the weighted average time that a bond needs to be held to recover its cost price.

Watch this video to understand the basics of bonds.

But what is the benefit of holding bonds with a Macaulay duration of one to three years? It helps the fund manage interest rate risks.

Apart from duration, bonds are affected by interest rates in the economy. Let us understand the relationship between interest rates and short term debt funds.

Short Term Debt Funds and Interest Rates

A bond’s current yield is the total return an investor earns from the bond. It is calculated as –

Current Yield = Annual coupon (interest) payment / current bond price

Suppose the face value of a bond is Rs 1,000. It pays an annual coupon of 5% i.e. Rs 50. This bond is currently trading in the market at Rs 1,100. So, its current yield is 4.54% (Rs 50/Rs 1,100).

After a month, the current market price of the bond increases to Rs 1,150. Its current yield will now become 4.34% (Rs 50/Rs 1,150).

Note the sequence of events.

- Current market price of the bond rises from Rs 1,100 to Rs 1,150. So, now you have to pay Rs 50 more for the bond.

- But the income (coupon) from the bond is the same i.e. Rs 50.

An increase in bond prices leads to a direct fall in its total return or current yields.

Now suppose the RBI reduces the interest rates from 4% to 3%.

What will happen now? The demand for a bond paying 4.34% yield will increase. When demand increases, the current market price of the bond will also increase. Remember that when market price increases, a bond’s current yield falls.

Things to Consider While Investing in Short Term Debt Funds

Apart from interest rate changes, there are various other factors that you must consider while investing in short term debt funds.

1. Credit Rating: A bond is nothing but a way for companies to raise capital. But how will you decide if a company is worthy of the loan? This is where credit rating chips in. Every bond or debt instrument is given a credit rating by credit rating agencies. The three main credit rating agencies in India are:

- Credit Rating Information Service of India Ltd (CRISIL)

- Investment Information and Credit Rating Agency of India (ICRA)

- Credit Analysis and Research Ltd (CARE)

Credit rating is provided after in-depth evaluation of the bond or company, issuer’s financial stability, track record etc.

If a bond gets a AAA rating, then it means the bond is safe and stable. Whereas a bond with D means there are very high chances of default.

Now you wouldn’t want to give your hard-earned money to a company with high chances of default, correct? This is why you must check a short term bond’s credit rating. If the underlying bonds are AAA rated then the possibility of default risk is less.

Watch this video to learn everything about credit rating in India

2.Type of Issuer: Sometimes a fund will invest in bonds with AAA rating but all bonds are issued by private issuers. This is an issue. As we saw during the lockdown, even big private sector companies were facing financial crunch. In such a situation, it might be difficult for them to repay the bondholders or investors.

Therefore, whenever you are evaluating a short term debt fund, ensure that the fund invests in bonds of various entities – Private, public and government bonds. The exposure to government bonds will give your fund added safety.

[Read More: Best Gilt Mutual Funds in 2021]

3. Modified Duration: This is another way of measuring a bond’s sensitivity to changes in interest rates. A high modified duration means the fund is more sensitive to interest rate changes.

Short term debt funds have modified duration between two to three years. Whereas, long term debt funds have much higher modified duration.

|

Type of Debt Fund |

Fund Name | Modified Duration |

| Short Term Debt Fund | HDFC Short Term Debt Fund | 2.26 years |

| Long Term Debt Fund | HDFC Income Fund | 4.73 years |

4. Average Maturity: This is the weighted average maturity of all the underlying bonds and debt instruments of a fund. It tells you the average years taken by the underlying papers to mature. As expected, short term bond funds will have lower average maturity. This helps them remain less sensitive to interest rates. This happens because in the shorter duration, it is much easier to predict interest rate movements.

5. Yield to Maturity (YTM): This is the total yield of the underlying bonds if they are held till maturity. For example, the YTM of Aditya Birla Sun Life Short Term Fund is 5.09%. This means that if the fund manager holds the bonds till maturity then the fund will generate 5.09% returns. Higher the YTM, the more your returns will be.

6. Risk Taken by the Fund: Standard deviation reflects a fund’s volatility. Higher standard deviation means the fund is risky. While investing in a short term debt fund, you must ensure that its standard deviation is in line with the benchmark and peers.

For example: DSP Short Term Fund‘s standard deviation is 1.86%. This is much higher than its benchmark standard deviation of 0.39%. This means the fund is taking higher risk. Taking high risk is not bad if the fund is able to generate higher returns. This can be analysed using risk-return ratios.

7. Risk-Adjusted Returns: Sharpe and Sortino ratio perfectly measure the return generated by a fund against the risk taken. The higher the Sharpe ratio, the better it is. Similarly, a high Sortino ratio shows that the fund is able to manage its downside risk. While investing in a short term debt fund, always ensure that it has high Sharpe and Sortino ratios.

8. Under or Over Diversification: Many times, fund managers become too conservative or aggressive. This ultimately affects the investors. This is why you must check the number of securities a short term debt fund holds. It should be in line with the benchmark and its peers.

| Fund Name | Total Number of Securities | Category Average | Diversification Level |

| HDFC Short Term Fund | 161 | 65 | Over Diversified |

| DSP Short Term Fund | 64 | 65 | Adequately Diversified |

| HSBC Short Duration Fund | 20 | 65 | Under Diversified |

Overdiversification can be harmful as your gains are spread too thin. Plus, you are hardly able to invest substantially in a high coupon bond to maximise your gains. Whereas, under-diversification can make it difficult for you to absorb your losses.

Should You Invest in Short Term Bond Funds?

Short term bond funds are beneficial when interest rates are rising. But currently interest rates are at multi-year lows. So, should you invest in short term bond funds now? Absolutely!

The RBI has maintained an accommodative stance on interest rates. This is why the repo rate is constant at 4% since May 2020. But the economy is slowly getting back to normal. As demand picks up, the RBI might start increasing the repo rate. Once that happens, there will be an overall increase in interest rates and the demand for short term bond funds will go up.

So, as soon as interest rates start moving up, you can shift a portion of your portfolio from long term debt funds to short term debt funds. This way you will be able to offset the lower returns from long term debt funds by the superior returns on short term debt funds.

*Returns as on 9th August 2021 **Data Source: www.rankmf.com

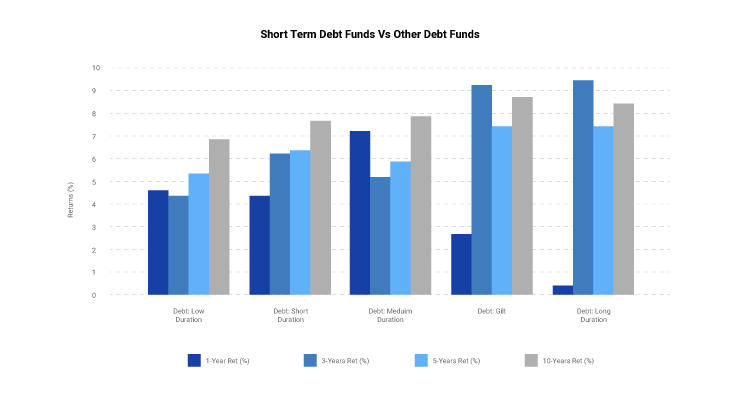

In the last one-year short term debt funds have performed very poorly. Even low duration funds like liquid funds have been able to beat them. This is because interest rates have fallen drastically in the last one year. But in the long-run, short term debt funds have easily beaten liquid and fixed deposit returns.

In the last one-year short term debt funds have performed very poorly. Even low duration funds like liquid funds have been able to beat them. This is because interest rates have fallen drastically in the last one year. But in the long-run, short term debt funds have easily beaten liquid and fixed deposit returns.

Risks in Short Term Debt Funds

Risks in debt funds can be divided into two main categories –

- Systematic risk

- Unsystematic risk

Systematic risk is a part of investing and cannot be avoided. Whereas unsystematic risk can be managed using diversification and asset allocation.

1. Credit Risk: This is a type of unsystematic risk. When interest rates in the economy are low, fund managers are tempted to invest in risky bonds as they provide higher returns. But this increases the overall risk profile of the fund. The best way to avoid this is by carefully studying the credit quality of the underlying bonds. If you are a conservative investor, then it is better to avoid a short term debt fund with low credit rating.

2. Reinvestment Risk: This is a systematic risk and cannot be eliminated. This usually happens when interest rates are falling. Suppose the current interest rate in the market is 5%. Your fund manager has invested Rs 100 crores in ABC bond offering 6% coupon. On maturity, the interest rates fall to 4%. The new bond has reduced the coupon rate to 5%. So, earlier your fund was earning Rs 6 crores as interest. But now it is earning Rs 5 crores. The difference of Rs 1 crore is the reinvestment risk.

3. Interest rate Risk: Short term debt funds perform poorly when interest rates are falling. During such times, fund managers prefer investing in long term bonds. This way they can lock-in their coupons for the long term.

Taxation of Short Term Debt Funds

The holding period for a short term debt fund is three years i.e. 36 months.

If you sell your short term debt fund before three years, you will incur short term capital gains (STCG). These gains are added to your income and taxed as per applicable tax slab. So, if you fall in the 20% tax bracket, you will have to pay 20% STCG.

If you sell your short term debt fund after three years, you make long term capital gains (LTCG). The LTCG tax on short term debt funds is 20% with indexation.

Let us now discuss the five best short term debt funds in 2021.

5 Best Short Term Debt Funds in 2021

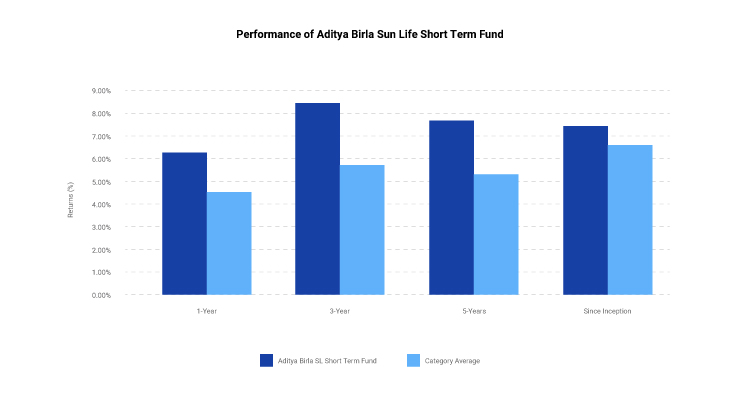

1. Aditya Birla Sun Life Short Term Fund: This is one of the best short-term debt funds in 2021 as it has given a one-year return of 6.22% amidst falling interest rates. The fund has a decent asset under management (AUM)of Rs 8,051 crores. It has generated an alpha of 4.49% over its benchmark.

The fund’s average maturity is 2.35 years and YTM is 5.09%. The fund is highly overdiversified (177 instruments) compared to the category average (64). The fund also holds 13.01% in AA rated papers and 0.93% in A and below papers, making it a little risky. However, it has managed its risk well as seen by a Sharpe of 1.89%.

*Data as on 12th August 2021 **Source: RankMF

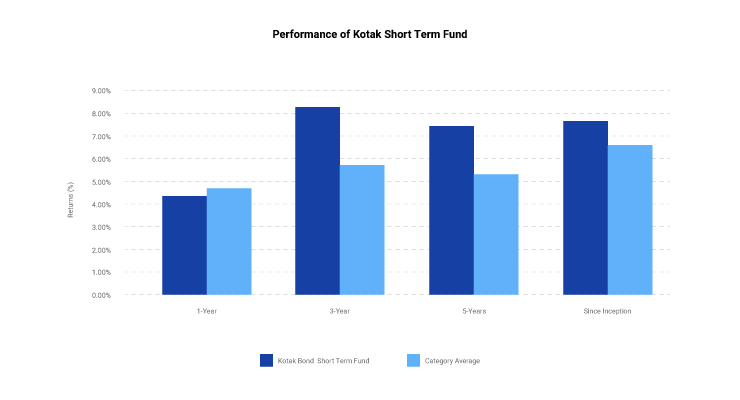

2. Kotak Bond Short Term Fund: This fund makes it to our list of best short term debt funds as it has generated superior risk-adjusted returns. The fund has lagged its peers with a one-year return of only 4.36%. But the fund has delivered an alpha of 5.02% with a low standard deviation of 1.84%. The fund invests in 131 debt instruments, all of which are AAA rated papers. So, Kotak Bond Short term fund is the best short term fund for conservative investors. But do note that It has a slightly higher average maturity of 3.24 years.

*Data as on 12th August 2021 **Source: RankMF

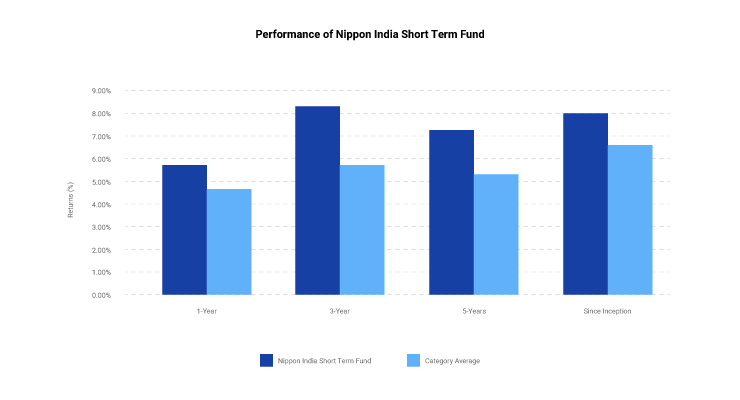

3. Nippon India Short Term Fund: Return-wise, this has been one of the top-performing short term debt funds in 2021. It has generated a return of 5.69% in the last one-year. It has done so without taking additional risks (standard deviation is 1.68% only). The fund has delivered an alpha of 4.7% and a Sharpe ratio of 2.24%. However, the fund does invest 11.70% in AA rated papers, which makes it slightly risky.

*Data as on 12th August 2021 **Source: RankMF

4. HDFC Short Term Debt Fund: This is one of the most popular short term debt funds as it has a massive AUM of Rs 18,684 crores. This is 279% higher than other schemes in the short term debt fund category. The fund has generated a decent one-year return of 5.43%. It has a modified duration of 2.13 years which makes it moderately sensitive to interest rate changes. The fund’s expense ratio is 0.75%, which is 49% lower than other funds in the category.

*Data as on 12th August 2021 **Source: RankMF

5. TATA Short Term Debt Fund: Finally, this is the fifth best short term debt fund in 2021 though it has an AUM of only Rs 2,845 Crores. It has also underperformed its category with a one-year return of 3.84% only. However, the fund is 100% invested in AAA rated papers which has affected its overall returns. The fund does have a slightly high expense ratio of 1.21%. But it has managed to deliver an alpha of 2.32%.

*Data as on 12th August 2021 **Source: RankMF

How to Invest in the Best Short Term Debt Funds in 2021?

You can invest in best short term debt funds in 2021 in less than 15 minutes with RankMF. Follow the below steps to invest in the best short term debt funds in 2021.

- Use your Samco Demat account credentials to login to RankMF. If you don’t have a Samco Demat account yet then open a FREE Demat account in less than 15 minutes!

- When you open a Samco Demat account you get FREE access to RankMF, KyaTrade and StockNote.

- Complete your Know your Customer (KYC) formalities. This will take you less than 5 minutes.

- Shortlist the short term debt fund you want to invest in.

- Register SIP or make lumpsum investments in your favourite short term debt fund and you’re done!

Leave A Comment?