What is Hybrid Mutual Fund?

As the name suggests, a Hybrid Mutual Fund is a combination of more than one type of fund. While they invest in shares of companies listed on the exchange, like equity funds. Like debt funds, they also invest in fixed-income instruments like bonds, debentures, treasury bills, etc.

Hybrid funds provide a mix of three major asset classes – equity, fixed income market and commodities market. With this, they provide dual benefits in the form of:

Capital appreciation from the equity portion.

Stable growth from the debt and gold allocation.

Hybrid mutual funds are actively managed open-ended funds. This means you can invest and withdraw from them throughout the year. There is no lock-in period.

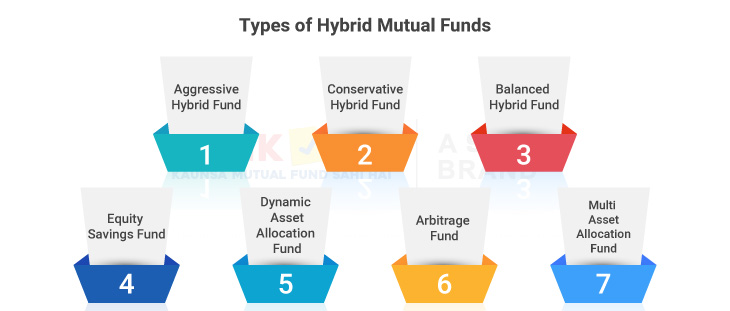

There are seven different types of hybrid funds in India.

The main goal of the fund manager is to benefit from price appreciation in all three asset classes while balancing the risk.

Hybrid Mutual Funds are safer than pure equity funds but are riskier than debt funds. Hence, they’re apt for moderately aggressive investors. This is also an excellent first step for beginners who want to test the waters before going all in.

Don’t know what mutual funds are? Watch this video to learn everything about mutual funds in India.

Where Does Hybrid Mutual Fund Invest?

The fund manager of a Hybrid Mutual Fund collects the corpus from investors and then divides it among equity, debt, and commodities. A hybrid mutual fund invests in the following:

Equity shares of large-cap, midcap and small-cap companies.

Debt instruments like corporate bonds, sovereign papers, commercial papers, zero coupon bonds, certificates of deposits, etc.

Commodities like gold, silver, crude oil, etc.

How Does A Hybrid Mutual Fund Work? – 3 Main Principles

Asset allocation is the process of deciding how much to invest in which asset class. If the stock market is declining, fund managers will shift to debt instruments for stability. And when the interest rates increase, they will shift to equity shares. For a successful hybrid fund to work, a healthy mix between equity, debt and gold is crucial.

Correlation is another important factor in hybrid funds. Will you invest in assets that rise and fall together? No!

An ideal portfolio has assets that are inversely proportional. This means if one asset goes up, the other will go down. So, your profit and loss are balanced.

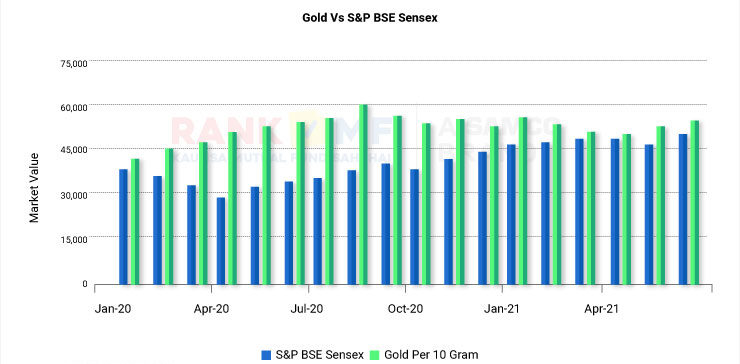

Equity, debt and gold are assets that are negatively correlated. The below chart shows the trend of equity and gold in the year 2020.

Source: BSE, Gold Price

Notice that when the equity markets fell, gold prices went up. Now if you had invested only in equity funds, you would have missed the rally in gold. But with hybrid funds, you can capture the ups and downs of all asset classes.

Diversification is the third principle of hybrid funds. Here, you split and spread your investment amount across multiple asset classes. This increases your overall return while reducing the risk. This is exactly what a hybrid mutual fund does. The fund manager divides the collected corpus into various asset classes.

Types of Hybrid Mutual Funds

There are seven different types of hybrid funds. Let us understand them one by one.

1. Aggressive Hybrid Fund: This type of hybrid fund invests a majority of its corpus in equity. It can invest 65% – 80% in equity with a balance 20% – 35% in debt. It is suitable for aggressive investors only with a long-term investment horizon. A major benefit of aggressive hybrid funds is that even though they invest 20%-35% in debt, they are still taxed as equity funds. So, the holding period is 12 months, not 36 months.

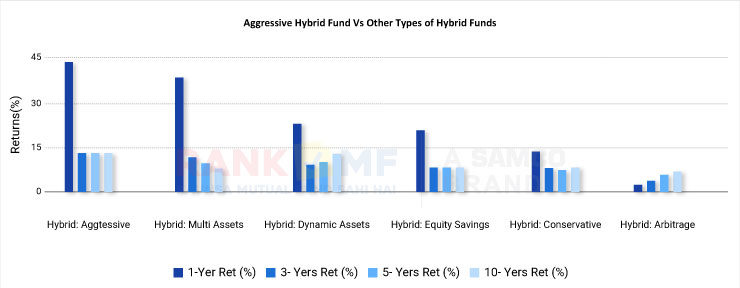

The below chart shows the performance of aggressive hybrid funds against other types of hybrid funds.

Source: www.rankmf.com **Data as on 13th July 2021.

As you can see, aggressive hybrid funds have generated the highest return across the short term (one to three years) and long-term (more than five years).

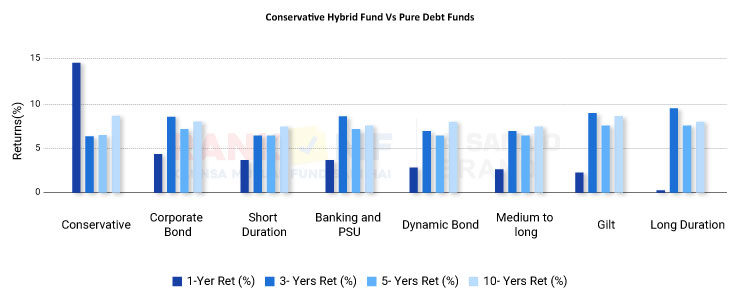

2. Conservative Hybrid Funds: This is a debt-oriented hybrid fund. It can invest 75 -90% in debt with the remaining 10-25% in equity. Because of the high exposure to debt, these funds are less volatile and risky than aggressive hybrid funds. They follow debt taxation i.e. their holding period is 36 months. The 10-25% allocation to equity helps them beat pure debt funds.

Source: www.rankmf.com **Data as on 13th July 2021.

As you can see, conservative hybrid funds have beaten all other types of debt funds across all time periods. They are perfect for low-risk investors who want to take a very little risk but earn better returns than debt funds.

What are debt funds? Watch this video to learn everything about debt funds in India

3. Balanced Advantage Funds: This third type of hybrid fund is a mix of aggressive and conservative funds. It invests 40% in equities and 60% in debt. An Asset Management Company (AMC) can either have an aggressive hybrid fund or a balanced advantage fund, but not both. These are a bit more aggressive in nature and are suitable for medium-risk investors with a time horizon of more than five years. These funds follow debt taxation.

4. Dynamic Asset Allocation Funds: The term dynamic itself means that there is no fixed equity-debt allocation. The fund manager can shift 100% of the corpus to equity or debt based on market movements. This makes them riskier than conservative or balanced funds.

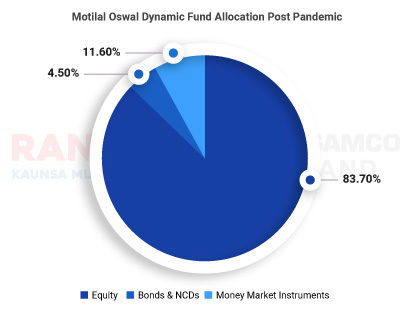

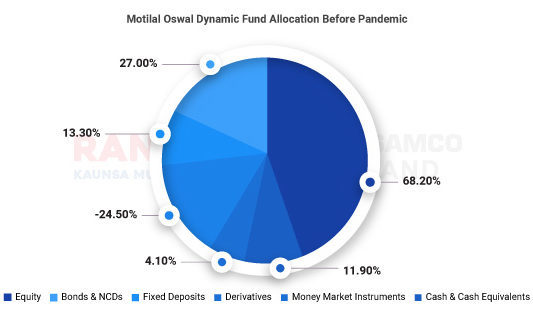

The below pie chart shows the asset allocation of Motilal Oswal Dynamic Fund before and after the pandemic.

Notice that when the equity markets fell, the fund manager quickly bought stocks as they were available cheaply. Hence, the equity allocation increased from 68.20% to 83.70%. The fund manager constantly changes the allocation as per movements in the market. Ideally, aggressive investors should invest in dynamic funds as they are highly volatile.

5. Equity Savings: This hybrid fund invests in equity, debt, cash and futures. It uses futures to reduce direct equity exposure and volatility. It performs arbitrage, which is simultaneous buying and selling in cash and futures market respectively.

[Read More: What are Arbitrage Funds?]

Equity savings fund invests 65 – 100% in equity stocks and the remaining 0-35% in debt instruments. They follow equity taxation where the holding period is 12 months.

6. Multi Asset Allocation Funds: This is a true type of hybrid fund as it invests a minimum of 10% in each of the asset classes…equity, debt and gold. It truly gives you the best of all worlds in just one scheme.

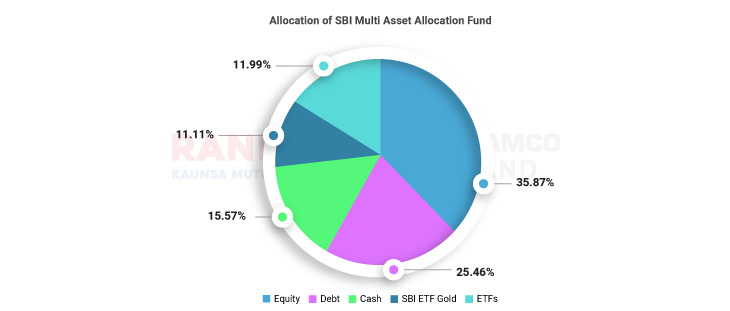

The below table shows the allocation of the SBI Multi Asset Allocation Fund

Source: www.rankmf.com **Data as on 13th July 2021.

Multi-asset allocation funds are the perfect way for retail investors as they capture the growth of all asset classes.

7. Arbitrage Funds: This is a unique type of hybrid fund which carries lowest risk. It buys shares in the cash market and simultaneously sells it in the futures market. The net position remains nil. So, the scheme carries lowest risk.

Principal Arbitrage Fund is one of the best arbitrage funds in India. It invests in the following stocks:

| Stocks | Allocation (%) |

| ICICI Bank | 9.63 |

| Bharti Airtel | 9.45 |

| Dr Reddy’s Laboratories Ltd | 9.41 |

| Larsen & Toubro Ltd | 7.19 |

| Aurobindo Pharma Ltd | 6.97 |

| Grasim Industries | 5.93 |

| JSW Steel Ltd | 5.13 |

| Infosys LTD | 3.95 |

| Reliance Industries Ltd | 3.66 |

| DLF Ltd | 2.57 |

| Axis Bank Ltd | 2.49 |

| Zee Entertainment Ltd | 1.79 |

| State Bank of India | 1.75 |

Source: www.rankmf.com **Data as on 13th July 2021.

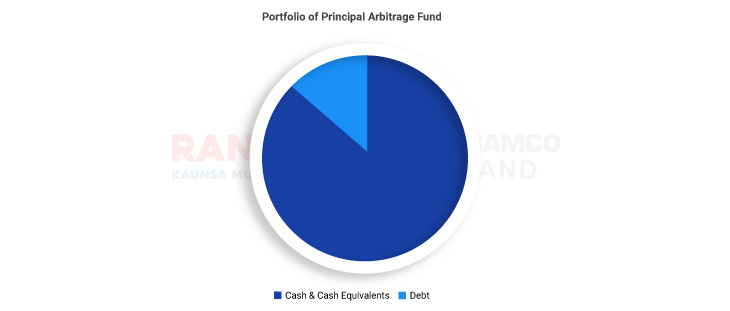

But if you see the fund’s portfolio, it is only in cash and debt. This is because the fund has already sold these shares in the futures market.

Source: www.rankmf.com **Data as on 13th July 2021.

Arbitrage funds are perfect for investors who want the benefit of equity with the lowest risk.

[Read More: What are Arbitrage Funds?]

6 Advantages of Hybrid Mutual Funds – 6 Reasons Why You Should Invest in Hybrid Funds

Single Point Access To Different Asset Classes: This is one of the biggest advantages of hybrid funds. When you invest in a hybrid fund, you get access to equity, debt, gold, silver, and other commodities in a single place. This helps you maintain a relatively smaller portfolio without compromising on assets and diversification.

Lower Expense Ratio: With single-point access, hybrid funds also help you save a lot of money in the form of an expense ratio. Suppose you want to invest in equity, debt and gold funds but on an individual basis, you will incur the following expense ratios:

| Scheme Name | Asset Class | Expense Ratio |

| Axis Bluechip Fund – Regular – Growth | Equity | 1.77% |

| Axis Short-Term Debt Fund – Regular – Growth | Debt | 0.99% |

| Axis Gold Fund – Regular – Growth | Gold | 0.61% |

Source: www.rankmf.com **Data as on 13th July 2021.

So, you end up paying a total expense ratio of 3.37%. Whereas the expense ratio of Axis Triple Advantage Fund is only 2.31%. So, you get instant savings of 1.06%. Also, there is a 55% overlap between the portfolios of Axis Bluechip Fund and Axis Triple Advantage Fund. So, you do not miss out on key stocks.

3. Automatic Rebalancing: One of the biggest arguments against hybrid funds is that asset allocation can be done by investors themselves. There is no need for a fund manager.

But how many investors track their portfolios every month? Or monitor the commodities market or interest rate movements? Very few.

Investors invest in mutual funds for expert advice and timely portfolio rebalancing. Both of these things happen automatically in a hybrid mutual fund. The fund manager will shift equity, debt and gold allocations as per the market movements and interest yields. Investors do not have to rebalance their portfolios manually.

4. Adequate Diversification: There are two layers of diversification in a hybrid mutual fund. First, it diversifies across asset classes like equity, debt and gold. But in equity also, it will diversify across large-cap, midcap and small-cap stocks. Similarly, it will invest in government papers, commercial papers, etc. This is not possible in a pure large-cap or midcap fund. So, you get two layers of diversification when you invest in hybrid funds.

5. Excellent Source of Dividends: Hybrid mutual funds are an excellent source of dividends. This is because they invest a big portion of their corpus in bonds, debentures etc. The interest earned on these bonds is distributed as dividends. They also earn dividends from equity shares. It’s like a double bonus.

ICICI Prudential Balanced Advantage Fund is one of the best-balanced funds in 2021. The fund has declared dividends every year since 2011.

| Date | Dividend Per Unit |

| 20-Oct-20 | 1.11 |

| 15-Oct-19 | 1.11 |

| 30-Oct-18 | 0.53 |

| 16-Mar-18 | 0.80 |

| 06-Oct-17 | 1.70 |

| 23-Sep-16 | 1.70 |

| 02-Sep-16 | 0.07 |

| 30-Sep-15 | 1.55 |

| 19-Sep-14 | 1.50 |

| 27-Sep-13 | 1.30 |

| 28-Sep-12 | 1.40 |

| 02-Sep-11 | 1.00 |

Source: www.rankmf.com **Data as on 13th July 2021.

This makes them perfect for retirees and senior citizens as they need a monthly source of income. However, it is not compulsory for mutual funds to give dividends. Hence investors must invest in only those hybrid funds which have a track record of giving dividends.

6. Suitable for Different Risk Profiles: Equity funds are suitable for aggressive investors. Debt funds are suitable for conservative investors. But hybrid funds work for both conservative and aggressive investors.

Aggressive and Dynamic hybrid funds are suitable for high-risk investors.

Conservative and Arbitrage hybrid funds are suitable for low-risk investors.

10 Things to Consider While Investing in Hybrid Mutual Funds

1. Returns: Many investors believe that since hybrid funds invest in fixed-income securities, they will generate stable fixed returns. However, this is not true. Hybrid mutual funds do not generate stable returns. In fact, aggressive hybrid funds can be more volatile than conservative hybrid funds.

2. Risk: This is another common myth regarding hybrid mutual funds. Different types of hybrid funds carry different degrees of risk. For example:

Aggressive hybrid funds are very risky.

Conservative hybrid funds carry low to moderate risk.

Arbitrage hybrid funds carry low to zero risk.

Hence, investors must carefully match their risk profile with the risk profile of the hybrid fund.

3. Turnover Rate / Churning Rate: This is the rate at which your fund manager buys and sells the underlying shares and debt securities. A high churning rate is not recommended as it means that the fund manager’s aim is not long-term investing. Constant portfolio churning also leads to high taxes and portfolio management fees for investors.

4. Taxation: This is very crucial while investing in hybrid funds. The taxation of hybrid funds keeps on changing as per the fund’s allocation.

For example: aggressive hybrid funds like HDFC Hybrid Equity Fund invests 74.4% in equity shares. Hence it follows equity taxation. Its holding period is 12 months. If you sell before 12 months, you need to pay flat 15% as short-term capital gains tax (STCG). But if you sell after 12 months, you need to pay long-term capital gains tax (LTCG) of 10% above Rs 1 Lakh.

On the other hand, Canara Robeco Conservative Hybrid Fund invests 69.7% in debt. So, it follows debt taxation. Its holding period is 36 months. If you redeem before 3 years, you need to pay STCG tax as per your income tax slab. If you redeem after 3 years, you need to pay LTCG tax at 20% with indexation.

Remember, different types of hybrid funds will have different taxation periods and rates. Hence, look at their asset allocation before redeeming them.

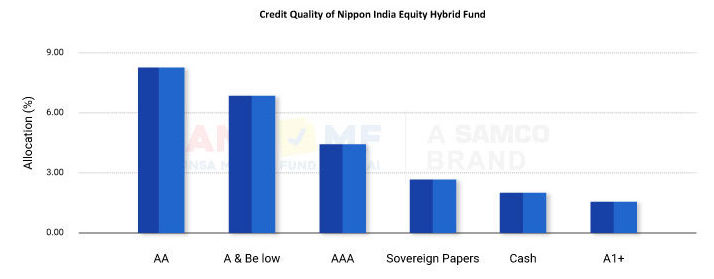

5. Credit Quality of Papers: Investors often forget that hybrid funds also invest in debt. Hence, analyzing its credit quality is a must. Let us take a look at the credit rating of Nippon India Equity Hybrid Fund.

Source: www.rankmf.com **Data as on 13th July 2021.

The fund invests 25.79% in debt instruments. However, it has a 15.38% allocation to AA and Below A papers. This increases its risk profile drastically. In comparison, Canara Robeco Equity Hybrid Fund has a 0% allocation to risky funds. Its entire debt portfolio is in AAA, Cash and Sovereign papers.

6. Expense Ratio: The fund manager of a hybrid fund has to track and manage two or three asset classes. He has to study the equity as well as the debt markets. For this reason, the expense ratio of hybrid funds is relatively more than pure equity or debt funds.

For example, the expense ratio of UTI Regular Savings Funds is 1.79%. This is higher than the expense ratio of Axis Bluechip Fund i.e. 1.77%. Hence, always compare the funds’ expense ratio before investing in a hybrid fund.

7. Risk-Adjusted Returns: Before investing in hybrid funds, you must check their risk-adjusted return.

What do you want when you invest in any fund? You want to beat the risk-free return given by bank deposits and treasury bills. This is why you must study key ratios like the Sharpe ratio, Treynor ratio, Standard Deviation, etc.

Sharpe Ratio is the extra returns generated by a fund over the risk-free return. A high Sharpe ratio is ideal. Standard deviation measures the volatility of a fund. A high standard deviation means the fund is taking more risks than its peers.

| Scheme Name | Nippon India Equity Hybrid Fund | Canara Robeco Equity Hybrid Fund | Category Average |

| Sharpe Ratio | 0.15 | 0.85 | 0.52 |

| Standard Deviation | 23.31 | 14.64 | 17.69 |

Source: www.rankmf.com **Data as on 13th July 2021.

The Sharpe ratio of Nippon India Equity Hybrid Fund is much lower than its peers and the category average. This means that the fund has not been able to compensate its investors for the risk taken.

Nippon India Equity Hybrid Fund’s standard deviation (23.31) is too high compared to its peers and category average. This clearly means that the fund is not for conservative investors.

Remember, a high standard deviation is acceptable only if the Sharpe ratio is also high. This is not the case with Nippon India Equity Hybrid Fund. It takes higher risks but delivers lower returns.

Hence, investors should always consider risk-adjusted returns before investing in hybrid funds.

8. Diversification: Even hybrid mutual funds suffer from a lack of diversification. Your hybrid fund invests in equity shares. To balance this, it also invests in bonds and debentures.

But what if it buys shares of only a few companies? Or a particular sector or market capitalization?

In that case, your hybrid fund will be as risky as a sectoral fund. For example: SBI Multi Asset Allocation Fund invests in 48 different stocks. Whereas Quant Multi Asset Fund invests in only 13 stocks! So, even though it is a hybrid fund, Quant Multi Asset Fund suffers from lack of diversification.

Investors should always ensure that the corpus is divided across various stocks to avoid concentration risk.

9. Concentration Risk and Valuations: A good hybrid fund has very little concentration risk. For example: SBI Multi Asset Allocation fund invests 55% of its equity corpus in top 10 holdings. Whereas HDFC Multi Asset Fund invests only 45%. A lower allocation to top 10 holdings is ideal.

Another thing to consider is the funds valuation ratios like price to earnings (PE) and Price to Book value (PB)

| Scheme Name | PE Ratio | PB Ratio |

| SBI Multi Asset Allocation Fund | 18.94 | 2.70 |

| HDFC Multi Asset Fund | 26.09 | 3.41 |

Source: www.rankmf.com **Data as on 13th July 2021.

A high PE ratio means the fund is investing in overvalued or rich stocks. This usually happens when the fund is following a growth investing strategy. Whereas low PE ratio indicates value investing strategy.

In the above example, SBI Multi-Asset Allocation Fund is investing in undervalued stocks. Whereas HDFC Multi Asset Fund is following growth investing strategy.

A high PB ratio is a sign of growth investing. While a low PB ratio means the fund is following value investing. Aggressive investors prefer growth investing. While conservative investors prefer value investing. Hence investors must match their risk profile with the fund’s investment strategy.

10. Exit Loads and Investment Horizon: Exit load is applicable is you redeem from a fund before a specific period of time. For equity mutual funds its 12 months. But unlike equity funds, different types of hybrid funds have different exit load periods.

| Hybrid Fund | Type of Hybrid Fund | Exit Load Period |

| Canara Robeco Equity Hybrid Fund | Aggressive Hybrid | For units in excess of 10% of the investment,1% will be charged for redemption within 365 days |

| UTI Regular Savings Fund | Conservative Hybrid | For units in excess of 10% of the investment,1% will be charged for redemption within 365 days |

| Nippon India Multi Asset Fund | Multi Asset Allocation | 1% for redemption within 365 days |

| SBI Arbitrage Opportunities Fund | Arbitrage | 0.25% for redemption within 30 days |

| Motilal Oswal Dynamic Fund | Dynamic Asset Allocation | 1% for redemption within 365 days |

| ICICI Prudential Balanced Advantage Fund | Balanced Advantage | For units in excess of 10% of the investment,1% will be charged for redemption within 365 days |

| Tata Equity Savings Fund | Equity Savings | For units in excess of 12% of the investment, 0.25% will be charged for redemption within 90 days |

Source: www.rankmf.com **Data as on 13th July 2021.

Arbitrage funds have an exit load of only 30 days. Equity savings funds have an exit load of 90 days. But aggressive hybrid funds have an exit load of 1 year.

Now imagine that you need the funds after 3 months but invest in a dynamic asset allocation fund! You will have to pay an unnecessary penalty of 1%. Hence, investors must match their investment horizon with funds exit load.

Are Hybrid Mutual Funds Taxable? – Hybrid Fund Taxation

Yes, hybrid mutual funds are taxable. For taxation purposes, hybrid mutual funds are divided into three categories:

- Equity-oriented hybrid funds include Aggressive hybrid funds, Arbitrage funds, and Equity Savings funds. For these funds, the holding period is 12 months.

- If you sell the units before 12 months, an STCG tax of 15% is applicable.

- If you sell the units after 12 months, an LTCG tax of 10% above Rs 1 Lakh is applicable.

2. Debt-oriented hybrid funds include Conservative hybrid fund, and Balanced hybrid fund. The holding period for these funds is 36 months i.e. three years.

- If you sell the units before 36 months, the gains will be added to your overall income and taxed as per the income tax slab.

- If you sell the units after 36 months, an LTCG tax @20% with indexation is applicable.

3. Dynamically taxable hybrid funds include Dynamic hybrid fund and multi-asset allocation fund. If these funds invest the majority of the corpus in equity, then equity taxation will be applicable. Otherwise, debt taxation will be applicable.

List of Best Hybrid Mutual Funds for 2021 in India

| Type of Hybrid Fund | Best Hybrid Mutual Fund for 2021 | Current NAV | 1 Year | 3 Years | 5 Years | Since Inception |

| Aggressive Hybrid | Canara Robeco Equity Hybrid Fund | 229.73 | 38.73% | 15.03% | 14.37% | 11.64% |

| Conservative Hybrid | UTI Regular Savings Fund | 48.02 | 17.94% | 6.13% | 7.23% | 9.33% |

| Multi-Asset Allocation | SBI Multi Asset Allocation Fund | 35.68 | 19.35% | 11.35% | 9.46% | 8.48% |

| Arbitrage Fund | LIC MF Arbitrage Fund | 11.09 | 3.05% | 0.00% | 0.00% | 4.29% |

| Dynamic Asset Allocation | Motilal Oswal Dynamic Fund | 15.09 | 13.93% | 7.54% | 0.00% | 8.96% |

| Balanced Advantage | IDFC Balanced Advantage Fund | 17.22 | 21.61% | 9.61% | 9.31% | 8.37% |

| Equity Savings | IDBI Equity Savings Fund | 20.16 | 20.51% | 7.88% | 6.17% | 7.00% |

*This is simply a list of the best hybrid funds in no particular order. This is not investment advice. Investor discretion is recommended. **Data as on 13th July 2021.

How to Invest in the Best Hybrid Mutual Funds in India?

You can invest in the best hybrid mutual funds in India in less than 15 minutes with RankMF. Follow the below steps to invest in the best hybrid funds for 2021.

Use your Samco Demat account credentials to login to RankMF. If you don’t have a Samco Demat account yet then open a FREE Demat account in less than 15 minutes!

When you open a Samco Demat account you get FREE access to RankMF, KyaTrade and StockNote.

Complete your Know your Customer (KYC) formalities. This will take you less than 5 minutes.

Shortlist the funds you want to invest in.

Register SIP or make lumpsum investments in your favorite Hybrid Mutual Fund and you’re done!

FAQs on Hybrid Mutual Funds

1.What is hybrid mutual fund?

A hybrid mutual fund is a mix of equity, debt and gold. It invests in equity shares as well as bonds, debentures, commercial papers, gold ETFs etc. The aim of a hybrid mutual fund is to earn superior returns from shares and get stability from the debt and gold portion.

2. What are the types of hybrid mutual funds?

There are seven types of hybrid mutual funds, namely:

- Aggressive Hybrid Fund invests 65% – 80% in equity shares and 20% -35% in debt instruments.

- Conservative Hybrid Fund invests 75% – 90% in debt and 10% – 25% in equity shares.

- Dynamic Asset Allocation Fund changes allocation dynamically as per market valuations. It can invest 100% in equity or 100% in debt.

-

- Multi Asset Allocation Fund invests minimum 10% in each asset class equity, debt and gold.

- Balanced Hybrid Fund invests minimum 40% in equity and 60% in debt.

- Equity Savings Fund invests in equity stocks, debt and derivative instruments like futures. The fund can invest up to 100% in equity shares.

- Arbitrage Funds are a unique type of hybrid fund as they hedge their cash position using futures contract. This means that the fund carries almost no risk.

3. What are the benefits of a hybrid fund?

Hybrid funds offer investors best of all the worlds…equity, debt, gold and other commodities. Investors can invest in all these asset classes with just one scheme. Here are five main benefits of a hybrid mutual fund:

- Access to multiple asset classes with a single fund.

- Adequate diversification

- Timely and automatic rebalancing as the fund manager tracks the portfolio.

- Suitable for all kinds of risk profile. High-risk takers can opt for aggressive hybrid fund or dynamic fund. Low risk takers can invest in arbitrage or conservative hybrid fund.

4. Are hybrid mutual funds taxable?

Yes, hybrid mutual funds are taxable. However, the taxation depends upon the type of hybrid fund.

- Aggressive, balanced advantage and arbitrage hybrid funds follow equity taxation. The holding period is 12 months. If you sell before 12 months, you need to pay STCG tax @15%. If you sell after 12 months, a LTCG Tax @10% above Rs 1 Lakh is applicable.

- Conservative and equity savings hybrid fund follows debt taxation. The holding period is 36 months. If you sell before 36 months, STCG tax as per income tax slab is applicable. If you sell after 36 months, LTCG tax @20% with indexation is applicable.

- The taxation of dynamic hybrid fund changes as per change in changes in allocation. If the fund manager keeps the entire corpus in debt, debt taxation will apply or else equity taxation is applicable.

5. Which is the best hybrid mutual fund in India?

Here’s a list of the seven best hybrid mutual fund in 2021.

- Canara Robeco Equity Hybrid Fund – Regular Plan – Growth Option

- UTI Regular Savings Fund – Regular Plan – Growth Option

- SBI Multi Asset Allocation Fund – Regular Plan – Growth Option

- LIC MF Arbitrage Fund – Regular Plan – Growth Option

- Motilal Oswal Dynamic Fund – Regular Plan – Growth Option

- IDFC Balanced Advantage Fund – Regular Plan – Growth Option

- IDBI Equity Savings Fund – Regula Plan – Growth Option

6. What is the difference between debt and hybrid mutual fund?

A debt mutual fund will invest 100% of its corpus in debt instruments. Whereas a hybrid mutual fund will invest in equity, debt and gold. Hybrid mutual funds are riskier than debt mutual funds.

7. What is the difference between hybrid fund and balanced fund?

Balanced fund is a type of hybrid fund only. It invests minimum 40% of the corpus in equity shares and the remaining 60% in debt instruments.

8. What does a hybrid mutual fund invest in?

A hybrid mutual fund invests in the following:

- Equity Shares of companies across large-cap, mid-cap and small cap sector.

- Debt instruments like bonds, debentures, zero coupon bonds, treasury bills etc.

- Commodities like gold, gold ETF, silver, crude oil etc.

- Futures especially arbitrage funds.

9. Five things to consider before investing in hybrid mutual funds

Here are the five things you should consider before investing in hybrid mutual funds.

- Returns generated by the fund across bull and bear markets.

- Risk-adjusted returns – Sharpe, Treynor and Standard Deviation.

- Credit quality of underlying debt papers.

- Expense ratio and exit load of the fund.

- Level of concentration risk and diversification

10. Who should invest in hybrid mutual funds?

Hybrid mutual funds are perfect for conservative investors as they have the debt component to balance risk of equities. Beginners who do not want to expose themselves 100% to stock market should invest in hybrid mutual funds. Retirees and senior citizens can also invest in hybrid mutual funds giving consistent dividends.

Leave A Comment?