In a systematic investment plan or SIP , investors invest a small amount of money at regular intervals. With ample time, these small investments grow into a huge corpus. But not all SIPs can help you create wealth. Investors must find and invest only in the Best SIP to create long-term wealth. Which is the best SIP to invest in 2021? Well, let’s find out!

What is a SIP?

There are two ways to invest in mutual funds – Lumpsum and SIP. In lumpsum investing, you invest the entire investment amount at one-go. Whereas a SIP allows you to invest a fixed amount at regular intervals. This can be weekly, monthly or quarterly.

For example, suppose you have received Rs 1 Lakh as incentives and want to invest it in mutual funds. If you invest the entire Rs 1 Lakh on a single day, then you have made a lumpsum investment. On the other hand, if you decide to invest this Rs 1 Lakh over a 10-month period, then you have done a SIP of Rs 10,000.

Now this does not mean that you have to login to your bank account every month and manually transfer Rs 10,000 on the same date every time. SIPs are automated, which means that you only have to register it once. Thereafter, it is automatically debited from your bank account and invested in the mutual fund scheme. You are free to select the SIP dates and the SIP frequency – daily, weekly, monthly or quarterly.

What are the Different Types of SIP?

Innovation has truly changed the mutual fund industry for the better. Apart from the normal SIP, there are three other types of SIPs in India –

- Top-Up SIP: This type of SIP allows you to increase your SIP amount by a fixed amount or percentage after a specific period of time. For example, you started a SIP of Rs 500 in a mutual fund scheme on 1st April 2020. After a year, you received a raise at work and decided to top-up your SIP amount by another Rs 500. A top-up SIP helps you achieve your financial goals faster.

- Flexible SIP: In a flexible SIP, investors can increase or decrease their SIP amount as per their will and budget. For example, investors facing financial crunch can decide to reduce their SIP instead of stopping it completely. A flexible SIP will allow investors to do so.

- Perpetual SIP: In a normal SIP, you mention the start date and the end date of the SIP. Say for example, you started a SIP of Rs 5,000 on 1st April 2015 for 5 years. So, 1st April 2020 will be the end date for this SIP. A perpetual SIP is when you do not state the end date. So, unless you manually submit a form or instructions, the SIP will go on forever.

Now that you understand what is SIP, let us understand how a SIP works.

How Does a SIP Work?

When you register a SIP, you are using your capital to buy units of a mutual fund scheme. These units are sold to you on a net asset value (NAV). Think of NAV as the purchase price of any goods and services. If you pay Rs 10 for a pen, then the pen’s NAV is Rs 10. Similarly, mutual fund units are also bought and sold on the basis of NAV. An important thing to note here is that NAV remains the same for lumpsum and SIP.

Now assume I want to start a SIP of Rs 5,000 in Canara Robeco Bluechip Equity Fund. The fund’s NAV i.e. the price of one unit of the fund is Rs 41.88. So, the fund will allot me 119.38 units (Rs 5000/Rs 41.88). Now, if the NAV of the fund on 30th October 2021 is Rs 42.88, then I will get 116.60 units. This brings us to an interesting observation –

- When NAV goes up = Your SIP fetches less units

- When NAV falls = Your SIP will fetch more units

The NAV of a mutual fund scheme is never constant. It goes up and down as per the market. Now you might think that in that case, NAV should never go up or should be constant. This way you will get more units. But you will miss out on the biggest advantage of SIP – Rupee Cost Averaging.

Benefits of a SIP – Advantages of a Systematic Investment Plan

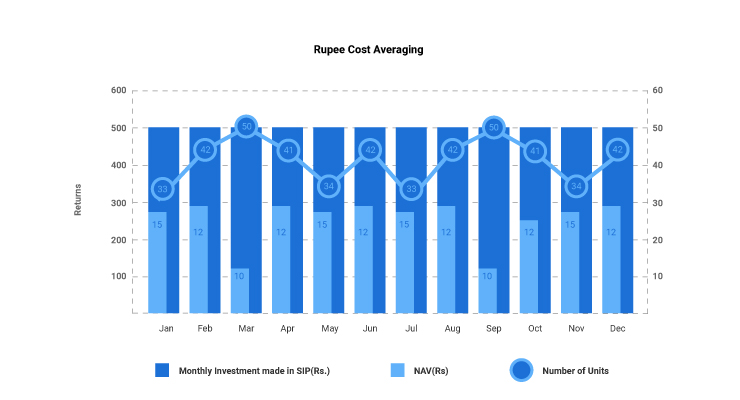

1. Rupee-Cost-Averaging: This is one of the biggest advantages of a SIP. Rupee cost averaging is a strategy that gives you immunity against market ups and downs. It averages your purchase cost and maximizes returns. Suppose an investor starts a SIP of Rs 500 per month for 12 months. This is how rupee cost averaging will work for him –

- The NAV in January is Rs 15, so he will get 33.33 units (500/15).

- The NAV in March falls to Rs 10. Now, he will get 50 units.

This keeps on happening throughout the year. At the end of the 12-month period, he has accumulated 484 units at an average cost of Rs 12.67 per unit. Now suppose he had selected to invest the entire Rs 6,000 (Rs 500*12 months) in January itself. He would have accumulated 400 units at an average cost of Rs 15 per unit.

So, rupee cost averaging has helped him accumulate more units (484 vs 400) at a lower cost (Rs 12.67 vs Rs 15). Rupee cost averaging helps you get more units when the markets are lagging and fewer units when markets are booming.

Now suppose that the NAV of the fund in the following January is Rs 13. Since he has invested via SIP, his average cost price is Rs 12.67 per unit. Hence, his overall profit is Rs 0.33 per unit. But if he had invested via lumpsum, then he would be facing a loss of Rs 2 per unit. Hence, rupee cost averaging is the biggest advantage of a SIP.

2. Power of Compounding: The second biggest advantage of a SIP is that it manifests the power of compounding. The concept of compound interest is that interest is added back to the principal amount. So, interest is earned on that added interest during the next compounding period. Due to this, a small sum of money invested regularly can grow into a huge corpus.

| SIP Amount | Rate of Return | Time Frame | Future Value | Invested Corpus | Power of Compounding |

| 1,000 | 15% | 30 years | 70,09,821 | 3,60,000 | 66,49,821 |

| 2,000 | 15% | 30 years | 1,40,19,641 | 7,20,000 | 1,32,99,641 |

| 5,000 | 15% | 30 years | 3,50,49,103 | 18,00,000 | 3,32,49,103 |

| 10,000 | 15% | 30 years | 7,00,98,206 | 36,00,000 | 6,64,98,206 |

If you start a SIP of Rs 1,000 every month for the next 30 years, then you have invested a total of Rs 3.6 lakhs. Now due to the power of compounding, your corpus is worth a whopping Rs 70 Lakhs!

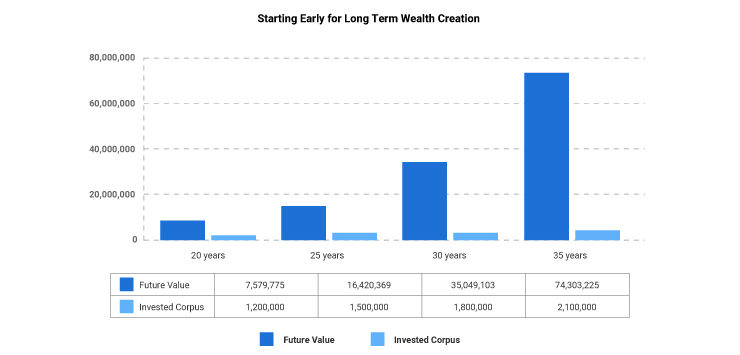

3. Long-term Wealth Creation: The best aspect of a SIP is that investors can start with as little as Rs 100 and still build a decent sized corpus. However, the more time you give to your SIPs, the more humongous your corpus will be. The graph below shows wealth creation by starting SIP at various stages in life.

As you can see, a SIP of Rs 5,000 for 20 years can help you create a corpus of Rs 75.79 lakhs. But if you just add another 5 years or Rs 3 lakhs, your corpus grows from Rs 75 Lakhs to Rs 1.64 crores! Hence, if you want a huge corpus then you must start investing early and stay invested for the long-term.

If you believe that starting late can be compensated by investing more, then you are in for a surprise. Ram started a SIP of Rs 5,000 for 20 years. His corpus at the end of 20 years was Rs 75.79 lakhs. While Shyam doubled his SIP amount to Rs 10,000 but still his corpus was only Rs 67.68 lakhs. Hence, SIP helps in creating long-term wealth only if you give it ample time.

| Time Frame | SIP |

Future Value |

|

| Ram | 20 years | Rs 5,000 | Rs. 75,79,774 |

| Shyam | 15 years | Rs 10,000 | Rs. 67,68,630 |

4. Disciplined approach: Majority of investors miss out on the benefits of SIP because they are obsessed with timing the market. However, truth be told, there is no guaranteed way of predicting market movements. And by delaying your investments, you are missing out on one of the most precious resources, time. SIP helps inculcate investment discipline in investors. Your SIP continues regardless of whether the market is up or down. So, investors do not have to stress in trying to time the market. Simply continue your SIPs, especially when the markets are down and reap the power of compounding.

5. Simple, Convenient & Affordable: SIP is highly convenient. It authorizes your bank to make hassle-free payment without your involvement every single time. So, once a SIP is registered, all future payments are automatically debited from your account without your supervision. Another key advantage of SIP is that it is highly affordable. Investors can start SIP with as little as Rs 100.

6. Higher Inflation-Adjusted Returns: If you’re a small-time investor and do not possess the resources to play with the big-league players, then SIP is the solution. With SIP, even retail investors can earn above-average inflation-beating returns compared to traditional instruments like recurring deposits, fixed deposits, and PPFs. The risk component is averted due to the diversified portfolio of the scheme.

How to choose the best SIP Plans using RankMF?

If you don’t know which mutual funds to invest in, simply log in to RankMF. To access our proprietary ratings, you need to open a free paperless account with us. Once you do so, simply browse through our ratings of top mutual funds in each category. Here you will find truly ‘Sahi’ and best mutual funds for your SIPs.

Here is how to invest in Mutual Funds through SIP mode using RankMF.

Process to invest in Best SIP with RankMF

At RankMF, we provide an online investment platform wherein we rate and rank all the mutual funds schemes. We evaluate every mutual fund and help you select the best mutual funds. To begin your SIP Investment, click on the image below:

- Select the fund you want to start the SIP in. You can do this by going through the mutual fund rankings available on RankMF, or by referring to our list of top SIP funds below.

- Once you’ve selected the mutual fund you want to invest in, click on ‘SIP’ at the top/upper-right corner of the page.

- Now, enter your SIP amount and select the date for monthly SIP deduction and other details to initiate your SIP.

- Ensure sufficient funds in your Samco account/bank account every time the SIP is due.

- The amount opted for the SIP is debited automatically from your bank account and invested into the specific mutual fund on the pre-decided date every time.

- If you wish to check your account balance, log into RankMF, go to Account > Order History and SIP Calendar.

- To increase your SIP amount, you can place another order along with the existing one. To decrease the amount, you should cancel the existing SIP and start a new SIP with a lower amount.

- One can stop SIP anytime by simply logging into your RankMF account and clicking on ‘Cancel’.

Best SIP in 2021-22

| Best SIP in 2021 | Type | 3-Year Returns |

| Mirae Asset Large Cap Fund | Large Fund | 18.35% |

| LIC MF Large & Midcap Fund | Large & Mid-Cap Fund | 15.46% |

| L&T Midcap Fund | Mid-cap Fund | 14.55% |

| SBI Small cap Fund | Small-cap Fund | 14.16% |

| Mahindra Manulife Flexi cap Yojana | Flexi-cap Fund | 14.14% |

| Union Hybrid Equity Fund | Aggressive Hybrid Fund | 13.45% |

(Source: RankMF as on 5th October 2021)

Let us take a closer look at the best SIP plans in 2021.

1. Best SIP in Large-cap Category: Mirae Asset Large Cap Fund

Fund Strategy: The investment objective of Mirae Asset Large Cap Fund is to generate long term capital appreciation by capitalizing on potential investment opportunities by predominantly investing in equities of large cap companies

| RankMF Ratings | 4-Star |

| Minimum SIP Amount | Rs. 1,000 |

| Fund Launch Date | 4th April 2008 |

| AUM | Rs. 29,425 crores |

| Expense Ratio | 1.60% |

| Exit Load | 1% on redemption before one year.

Nil after one year |

| Benchmark | Nifty 100 TRI |

| 1-year return | 53.83% |

| 3-year return | 21.31% |

| 5-year return | 16.55% |

2. Best SIP in Large & Midcap Fund Category: LIC MF Large & Midcap Fund

Fund Strategy: The objective of the fund is to generate capital appreciation by investing in a diversified portfolio of large and mid-cap stocks.

| RankMF Ratings | 3-Star |

| Minimum SIP Amount | Rs. 1,000 |

| Fund Launch Date | 25th February 2015 |

| AUM | Rs. 1,412 crores |

| Expense Ratio | 2.44% |

| Exit Load | For units in excess of 12% of the investment, 1% exit load applicable on redemption within one year. |

| Benchmark | Nifty LargeMidcap 250 Index – TRI |

| 1-year return | 57.22% |

| 3-year return | 22.78% |

| 5-year return | 15.36% |

3. Best SIP in Midcap Category: L&T Midcap Fund

Fund Strategy: The fund’s objective is to generate capital appreciation by investing in midcap stocks.

| RankMF Ratings | 4-Star |

| Minimum SIP Amount | Rs. 500 |

| Fund Launch Date | 9th August 2004 |

| AUM | Rs. 6,948 crores |

| Expense Ratio | 1.87% |

| Exit Load | For units in excess of 10% of the investment, 1% exit load applicable on redemption within one year. |

| Benchmark | Nifty Midcap 100 TRI |

| 1-year return | 55.20% |

| 3-year return | 19.84% |

| 5-year return | 15.04% |

4. Best SIP in Small-cap Category: SBI Small Cap Fund

Fund Strategy: The fund’s objective is to generate capital appreciation by investing in stocks of small cap companies.

| RankMF Ratings | 4-Star |

| Minimum SIP Amount | Rs. 500 |

| Fund Launch Date | 9th September 2009 |

| AUM | Rs 9,714 crores |

| Expense Ratio | 1.75% |

| Exit Load | 1% on redemption within one year.

Nil after 1 year |

| Benchmark | S&P BSE Small Cap TRI |

| 1-year return | 73.56% |

| 3-year return | 28.71% |

| 5-year return | 21.66% |

5. Best SIP in Flexi Cap Category: Mahindra Manulife Flexi-cap Yojana

Fund Strategy: The fund’s objective is to achieve long term capital appreciation by investing in stocks across market capitalisation – large, mid and small-caps.

| RankMF Ratings | 4-Star |

| Minimum SIP Amount | Rs. 500 |

| Fund Launch Date | 23rd August 2021 |

| AUM | Rs. 736 crores |

| Expense Ratio | 2.43% |

| Exit Load | 0.5% on redemption within 90 days |

| Benchmark | Nifty 500 TRI |

6. Best SIP in Aggressive Hybrid Fund: Union Hybrid Equity Fund

Fund Strategy: The fund’s objective is to achieve long term capital growth and generate income from a portfolio of equity and equity related securities. The scheme will also invest in debt & money market instruments.

| RankMF Ratings | 5-Star |

| Minimum SIP Amount | Rs 2,000 |

| Fund Launch Date | 18th December 2020 |

| AUM | Rs. 518 crores |

| Expense Ratio | 2.49% |

| Exit Load | 1% for redemption within 15 days |

| Benchmark | CRISIL Hybrid 35+65 Aggressive index |

How to Invest in Best SIP in 2021?

You can invest in the best SIP in 2021 in less than 15 minutes with RankMF. To invest in the best SIP plans, follow the below steps:

- Open a FREE RankMF account in less than 15 minutes!

- Complete your Know your Customer (KYC) formalities. This will take you less than 10 minutes.

- Shortlist the SIP you want to invest in.

- Register your SIP and you’re done!

For more information about investing in mutual funds, stock trading and useful related articles, visit RankMF.com or our investor education centre.

(Note: This content is for information purpose only. Avoid trading and investing based on the information given above. Before investing in stocks or mutual funds, please conduct proper due diligence).

FAQs on Best SIP

- Which SIP is best for 1 year?

The best SIP for 1 year if you are a conservative investor would be in debt funds like overnight funds, liquid funds, ultra short-term funds etc. While the best SIP for 1 year if you are an aggressive investor can be in large cap mutual funds or arbitrage funds.

- Lumpsum or SIP? Which is better?

Lumpsum is ideal for experienced investors who have the time to track and time the markets. But lumpsum investing will show results only if the market goes up after your purchase. It does not help in rupee cost averaging. Whereas SIP is perfect for retail investors as they don’t have to bother with timing the market and can buy at every fall.

- Should I start SIP when markets are high?

Many investors miss out on creating wealth as they are afraid to start SIP when markets are high. They even stop their existing SIPs when markets are at their peak. But this is a very short-term approach to investing. Today’s market high can be inconsequential after 10 years. So, do not spend too much time worrying about market peaks and continue with your SIPs for long term wealth creation.

- Can I cancel my SIP anytime?

Yes, you can cancel your SIP anytime by submitting a physical form, informing your bank or cancelling your SIP online. It takes 30 working days to stop or cancel a SIP.

- Can I withdraw my SIP anytime?

Yes, you can withdraw SIP anytime but you will be liable to pay long term or short term capital gains tax. Also, you cannot withdraw your ELSS SIP units before three years. Each SIP instalment has to complete 12 months for long-term capital gains tax to be applicable. For example, if you start a SIP on 1st January 2020, then you can withdraw it post 1st January 2021. But the second instalment (1st February 2020) can be withdrawn post 1st February 2021 only otherwise short term capital gains tax of 15% will be applicable.

- How long can we invest in SIP?

You can invest in SIP perpetually also. But ideally you should register SIP in line with your financial goals.

- Is SIP required in debt funds?

Since the NAV of debt funds does not fluctuate a lot, you can invest lumpsum in debt or liquid funds if you have the capital. Otherwise you can simply register SIP in debt funds.

- What is the difference between SIP and STP (Systematic Transfer Plan)?

In SIP, the instalment amount is debited from your bank account. Whereas in a STP, you first invest a lumpsum amount in a liquid fund and then transfer small instalments to an equity fund. So, SIP is deducted from a bank account while STP is a transfer from one mutual fund scheme to another.

- Which is the Best SIP for long-term?

The best SIP for long-term depends on your risk-profile. If you are an aggressive investor, then best SIP for you can be in mid and small cap funds. Whereas if you are a conservative investor, then best SIP for long-term would be in aggressive hybrid or large and midcap funds.

- Can SIP amount be changed?

Once registered, the SIP amount cannot be changed. But you can top-up your SIPs or register a new SIP in the same folio.

- What should I do with my SIPs when the market is down?

Nervous retail investors often redeem or stop their SIPs when the market is down. But this is a wrong strategy. A falling market is a great time for SIP as you will get more units for the same SIP instalment. You can also invest a small lumpsum amount along with your SIPs when the market is down.

- What happens when SIP is not deducted for one or two months?

At times, investors might not have sufficient account balance and hence their SIP is not debited. In this case, your SIP will not be immediately cancelled. You will get three chances i.e. your SIP will be cancelled automatically only if three continuous months’ SIP is not deducted due to insufficient balance.

I want to know that if i start a sip by a specific bank account and after some years i want to change my bank account then is it possible to change my linked bank account ?

Hi Sir, please share your contact details at mobileapps@samco.in. Our executives will get back to you and explain the process to you in detail

A very nice methodology used in this article Sir. How simple is the language so that everyone can understand. I also liked the Disciplined approach and I have also written a similar post on Top 10 Mutual Funds for 2019.

https://arthikdisha.com/international-monetary-fund-objectives-functions/