Equity Linked Saving Scheme or ELSS has, in the last few years, rightly gained popularity for its tax saving benefits, which come under section 80C of The Income Tax Act, 1961. However, investing in the ‘right ELSS scheme’ could help you generate sustainable growth as well.

There are 39 ELSS schemes available in the mutual fund industry. However, if these schemes are examined allocation-wise, you will see a large chunk of them are large-cap companies. In fact, almost 70% of holdings are predominantly allocated in the equities of large-cap companies, leaving small-cap and mid-cap companies with smaller allocations.

Large-cap businesses can be considered wealth creators, but we can’t ignore the boom that India has recently witnessed through smallcap and midcap companies. Along with leading their respective sectors, these companies also play a major part in developing our nation.

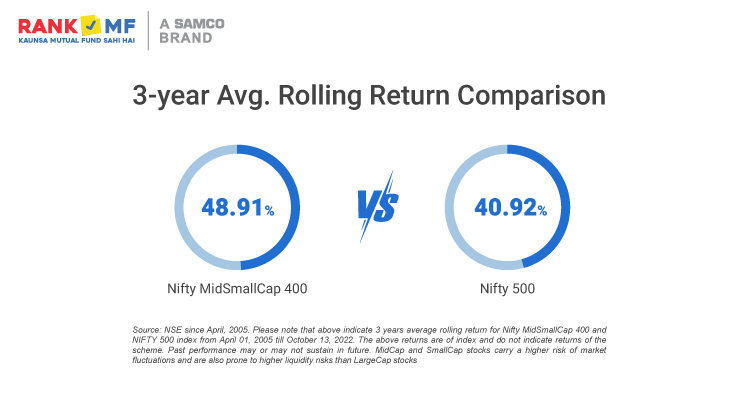

The rolling returns of mid-cap and small-cap indices for the last three years show a dramatic boost in investment returns by up to 8% and 9%, respectively, compared to large-cap indices.

The above data shows a clear difference in the peevish journey large-cap investment goes through. But that doesn’t conclude that large-caps are not worth the investment. Large-cap gives stability against the market, in process, generating moderate returns with tax benefits. On the contrary, Mid-cap & small-cap are fiercely volatile. These companies get impacted by any major event happening on a national or global level. However, the higher risk also means that higher returns will be delivered.

With extensive research and analysis around this concept, you can now start your investment in Samco ELSS Tax Saver Fund, which is the newest NFO to join RankMF. It is an open-ended ELSS scheme with a 3-year lock-in period and investors can avail tax benefits under section 80C of the Income Tax Act, 1961.

Samco ELSS Tax Saver Fund aims to outperform the benchmark by predominantly investing in equities of mid-sized and small-sized companies to generate high growth potential and tax benefits. The main idea for building such a unique portfolio is to encourage potential mid-cap and small-cap companies to become wealth creators of tomorrow.

The HexaShield Framework

The HexaShield framework is a strategy that filters out the businesses that can survive through stressful situations and generate long-term, risk-adjusted returns. These companies exhibit characteristics such as – surviving through economic distress, if occurred, and can operate as compounding machines in normal economic cycles.

In fact, out of 67,000 listed Global and Indian Equities, only 180+ listed stocks across the world have passed the rigorous HexaShield Testing process.

However, the Fund Manager plans to maintain a portfolio of 35 high-quality and Hexashield tested Mid-cap and Small-cap companies.

Here are the key objectives Samco ELSS Tax Saver Fund aims to achieve.

Why should you Invest in Samco ELSS Tax Saver Fund?

- SIP starting as low as 500/-

- Qualifies for Tax Deduction under Section 80C of the Income Tax Act, 1961.

- Long Term Capital Gains of up to ₹1 lakh are tax-exempt

- Higher risks and volatility, which can efficiently be managed due to a 3-year lock-in.

- Differentiated product offering with higher potential to generate alpha due to predominantly MidCap and SmallCap portfolio.

Conclusion

Samco ELSS Tax Saver Fund closes on December 16th 2022. You can start investing in it from just Rs. 500 and multiples of Rs. 500 hereafter. Invest now.

Leave A Comment?