Midcap funds are one of the most risky but lucrative types of mutual fund category. In the last one year, the midcap mutual fund category has given a stellar return of 67.92% (as of 14th September 2021).

Midcap mutual funds invest in fairly mid-sized companies with limited liquidity. This makes entry and exit difficult for investors. Since these companies are financially unstable, they are more prone to economic downturns.

Fortunately, you can manage this risk by understanding the basics of midcap mutual funds. In this article, we will do an in-depth study of midcap mutual funds. As a bonus, we will also take a look at the best midcap mutual funds in 2021-22.

A peak at the best midcap mutual funds in 2021-22

| Best Midcap Mutual Funds in 2021 | 1-Year | 3-Years | 5-Years | 7-Years | 10-Years |

| Axis Midcap Fund | 64.23% | 23.40% | 21.29% | 17.41% | 21.34% |

| DSP Midcap Fund | 50.77% | 19.23% | 16.24% | 16.74% | 18.66% |

| L&T Midcap Fund | 51.94% | 14.33% | 15.79% | 16.07% | 19.32% |

*Ranking as on 14th September 2021. **This is not investment advice.

In this article, we will cover –

What are Midcap Mutual Funds?

As per the Securities and Exchange Board of India (SEBI), midcap mutual funds invest minimum 65% of its corpus in midcap stocks. The remaining 35% is invested in large or small cap stocks and cash.

But what are midcap stocks?

Midcap stocks belong to companies with market capitalisation between Rs 5,000 to Rs 20,000 crores. These are the 101st to 250th companies ranked on the basis of market capitalisation. They are also referred to as upcoming large cap stocks or large cap stocks of tomorrow.

Unlike large cap funds, midcap funds do not invest in well-established and reputed companies. Instead they invest in relatively lesser-known companies which are still in the growth stage. This helps them generate much higher returns when the company rallies into the big leagues.

[Read More: Best Midcap Stocks to Buy in India Now]

For example – Axis Midcap Fund is one of the best midcap mutual funds in 2021. It holds shares of Sundaram Finance Ltd since April 2011. Its share price in April 2011 was Rs 264. Its share price today is Rs 2,657.50.

The fund and its investors have generated a compounded annual growth return (CAGR) of 25.97% in the last 10 years. So, your investment of Rs 10,000 would fetch you Rs 1 Lakh! This is the growth potential of midcap mutual funds in the long-term.

Midcap funds invest 35% of the corpus in large, small or cash instruments. This helps them reduce the overall risk and bring stability to the portfolio.

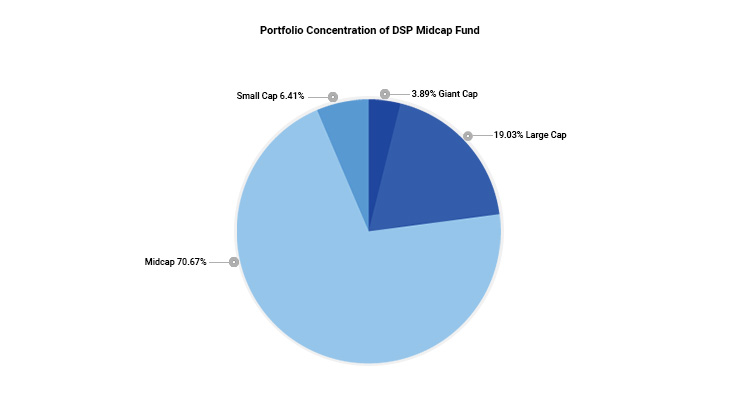

The below pie-chart shows the portfolio allocation of DSP Midcap Fund, one of the best midcap mutual funds in 2021-22.

Now that you understand what are midcap funds, let us look at why you should invest in midcap mutual funds.

What are the Advantages of Midcap Mutual Funds?

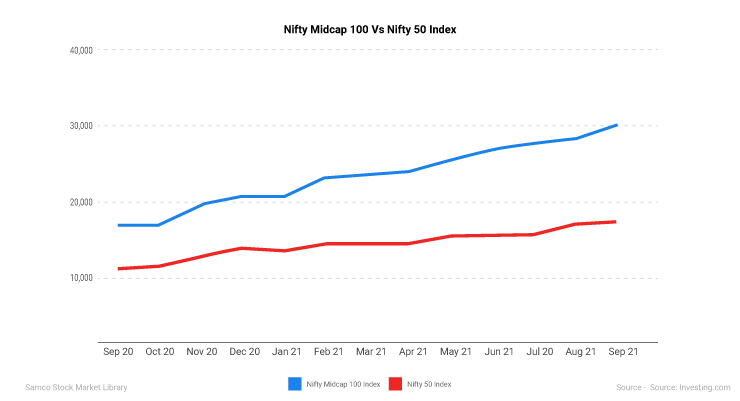

1. Superior Performance in Bull Markets: Historically, midcap mutual funds have outperformed large cap funds in bull markets. The below graph shows the performance of Nifty Midcap 100 index vs Nifty 50 index between September 2020 and 2021.

For: RankMF Knowledge Center | *Data as on 14th September 2021

The Nifty Midcap 100 index has generated a return of 80.63% in the last one year. While Nifty 50 index has generated a return of 53.55% only. So, the biggest advantage of midcap mutual funds is that they generate superior returns in bull markets.

2. Greater Diversification: Large cap mutual funds suffer from inadequate diversification. All large cap funds have the same pool of 100 stocks only. So, the majority of large cap funds end up investing in the same 20-30 stocks.

This is not the case with midcap mutual funds. They have a wider playing field with 150 stocks. Also, since these stocks are relatively unknown, different fund managers can have conflicting views on the same midcap stocks. So, the overlap between midcap mutual funds is relatively less.

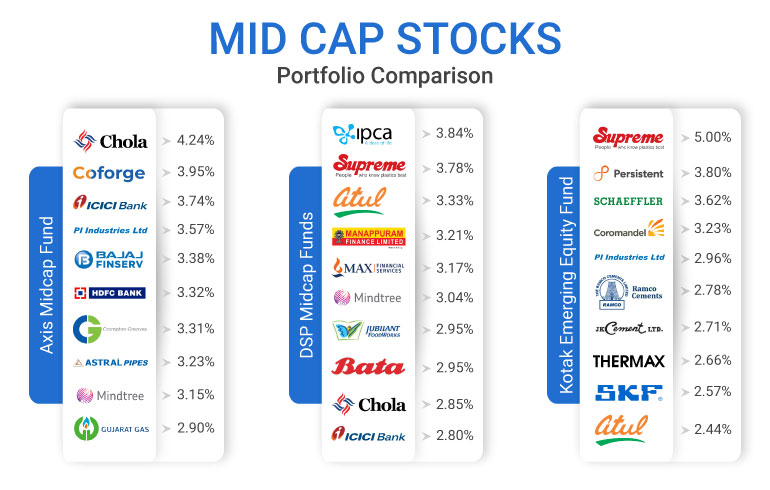

The below table shows the overlap between three best midcap funds to invest in 2021.

| Fund A | Fund B | Overlap |

| Axis Midcap Fund | L&T Midcap Fund | 24% |

| Axis Midcap Fund | DSP Midcap Fund | 30% |

| DSP Midcap Fund | L&T Midcap Fund | 26% |

Now compare this with the overlap between best large cap mutual funds of 2021.

There is a 51% overlap between Axis Bluechip Fund and Kotak Bluechip Fund.

- There is a 57% overlap between Kotak Bluechip Fund and UTI Mastershare Unit Scheme.

So, midcap funds give you greater diversification than large cap funds.

3. Better Liquidity: This is a crucial advantage of midcap mutual funds. Liquidity is the ability of the fund manager to sell the underlying stocks quickly. While large cap stocks are highly liquid, small cap stocks are illiquid. This makes it difficult for the fund manager to enter or exit positions. This is why a lot of small cap funds stop taking fresh money after a particular corpus limit is reached.

Midcap stocks are the way out here. They enjoy decent liquidity compared to small cap stocks. This gives the fund manager the bandwidth to capitalise on market ups and downs quickly without disrupting the share prices.

4. Perfect for Long-Term Wealth Creation: Midcap funds have a track record of generating superior returns in the long-term. In fact, the longer you hold, the higher returns you can generate. Hence, it is recommended to invest in midcap funds for a minimum 10 years to realise their full potential.

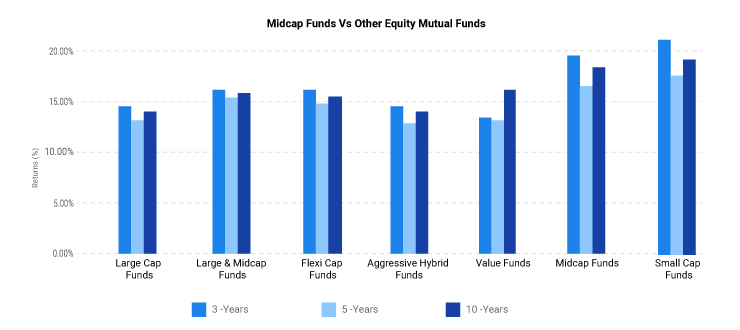

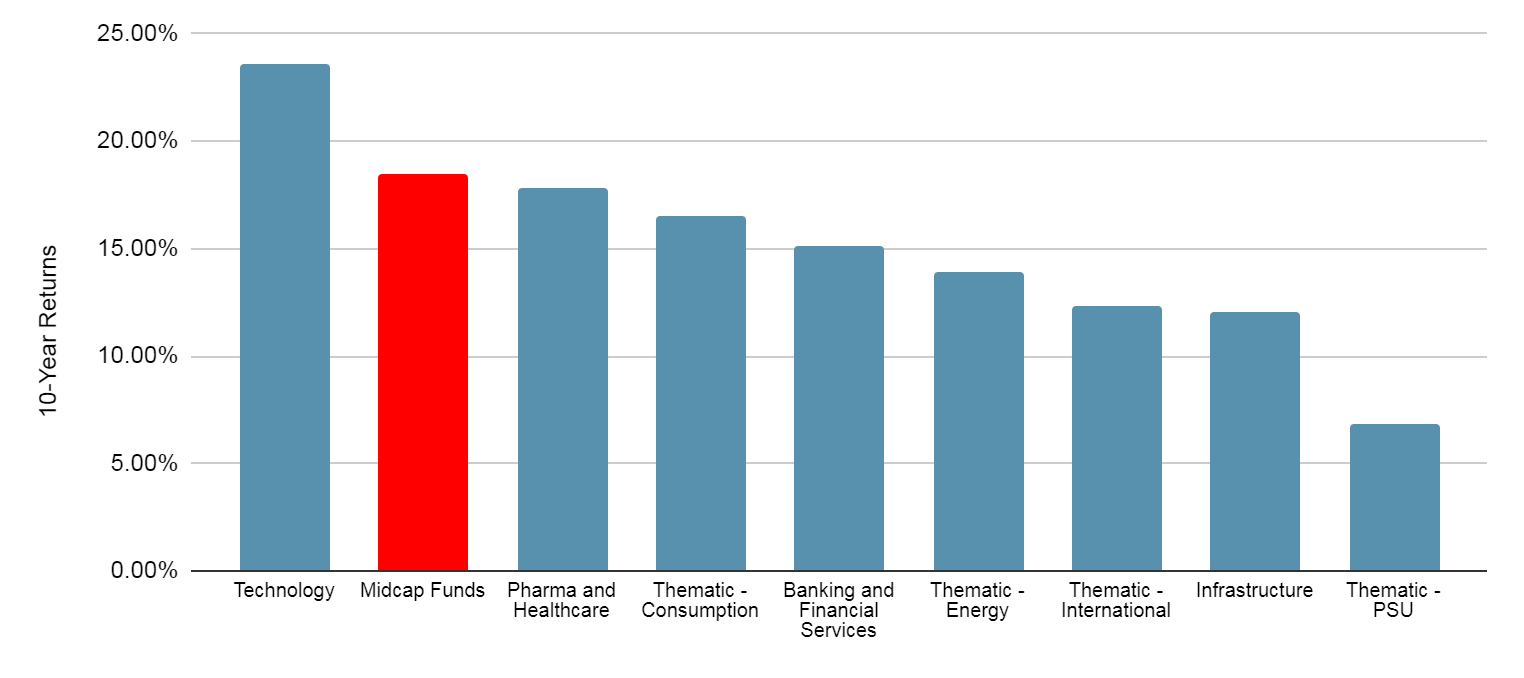

The chart below shows the long-term performance of midcap funds against other types of equity mutual funds.

For: RankMF Knowledge Centre | *Data as on 14th September 2021 **Source: RankMF

Midcap funds have beaten all other types of equity funds (except small cap funds) across different time frames. Hence, they are the best option for long-term wealth creation.

- The value of Rs 10 lakhs invested in midcap funds after 10 years would be Rs 54.32 lakhs.

- While, in large cap funds, it would fetch you Rs 38.19 lakhs only. This is the potential and power of midcap funds.

5. First-Mover Advantage: This is another great advantage of midcap funds. They offer you an opportunity to invest in large -cap stocks of tomorrow. Investors can buy these stocks in their developing stage and wait for them to spurt.

This is true for stocks like Mahanagar Gas Ltd. It has a market capitalisation of Rs. 10,708 crores. The stock has generated an absolute return of 89% between August 2016 to 2021.

6. Better Alternative to Thematic & Sector Funds: Investors often invest in sectoral and thematic funds to earn high returns. But this strategy can backfire. Sectoral and thematic mutual funds invest in a specific sector or theme. This makes them extremely risky as sectors often have long bear phases.

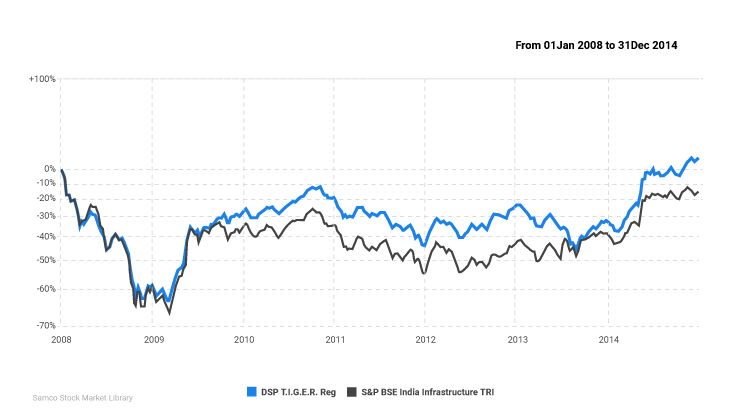

Let us consider the example of the DSP T.I.G.E.R fund. It is one of the most popular infrastructure funds. Its net asset value (NAV) barely grew between 2008 and 2014.

Disappointed investors exited the fund after waiting for nearly seven years. But shortly after, the infrastructure sector came into focus. The fund’s fortune quickly changed.

But how would you know whether a sector will work or not? This is why, selecting a particular sector or theme is not easy.

Midcap funds are an excellent alternative here. In the last ten years, midcap funds have outperformed the majority of sectoral funds. So, a key advantage of midcap funds is that investors do not have to depend on sectoral or thematic funds for higher returns.

The chart below shows the performance of midcap funds against thematic and sectoral funds in a 10-year period.

Midcap funds vs other equity mutual funds

For: RankMF Knowledge Centre | *Data as on 14th September 2021 **Source: RankMF

Midcap funds have outperformed most sectors and themes except technology. This makes them ideal for investors who want higher returns but with diversifiable risk.

Risks & Disadvantages of Midcap Mutual Fund

The biggest disadvantage of midcap mutual funds is that they are the worst hit during bear markets. Midcap stocks belong to relatively smaller companies. These companies are yet to establish themselves. So, they do not have brand loyalty or huge cash reserves. Hence, they are highly susceptible to economic shocks. The impact can be so severe that the companies often declare bankruptcy.

This is in contrast to large cap funds as large cap companies have huge cash reserves which helps them sustain economic downturns. This is why midcap funds fall more than large cap funds.

The below table shows the bear phase performance of midcap index vs large cap index.

| Bear Market: From | 05-Nov-2010 | 03-Mar-2015 | 14-Jan-2020 |

| To | 20-Dec-2011 | 25-Feb-2016 | 23-Mar-2020 |

| Nifty 100 TRI | -26.23% | -19.11% | -34.76% |

| Nifty Midcap 100 TRI | -33.74% | -13.03% | -37.49% |

During the 2010-11 bear phase, Nifty 100 TRI index fell 26.23%. Whereas Nifty Midcap 100 TRI fell by 33.74%. Hence, midcap funds have fallen more than large cap funds during bear markets.

It is not compulsory for a mutual fund to declare dividends. They pay dividends when their underlying holding companies declare dividends. This happens when companies have huge cash reserves. So, they share a portion of this reserve with shareholders as a token for their loyalty. Large cap funds have a track record of giving regular dividends.

But, midcap funds do not declare regular dividends. This is because midcap companies do not have huge cash reserves. Hence, they rarely pay dividends. Even if they do, it is not consistent.

For example – Nippon India Growth Fund is one of the oldest midcap funds in India. It was launched in 1995. It first declared a dividend in 2003, i.e. eight years after its launch.

Now look at the inconsistency of dividends.

- In 2018, it paid a dividend of Rs 9 per unit.

- This fell by 50% to Rs 4.5 per unit in 2021.

So, if you held 10,000 units, your dividend income fell 50% from Rs 90,000 to Rs 45,000.

So, while midcap funds are ideal for long-term wealth creation, they are not apt if you are expecting regular income.

Taxation of Midcap Mutual Funds

You can earn both capital appreciation and dividend income from midcap funds. But both of these incomes are taxed differently.

Midcap Fund Taxation on Capital Gains: The holding period of midcap mutual funds is 12 months.

- If you sell your units before 12 months, a flat short-term capital gains tax of 15% is applicable.

- Whereas if you sell your units after 12 months, your long-term capital gains will be taxed at 10% after indexation above Rs 1 lakhs.

Midcap Fund Taxation on Dividends: Before 2020, dividends were paid after deducting a dividend distribution tax of 28%. But this was changed in the Union Budget 2020. Dividend income is now taxed in the hands of individual investors as per their respective tax slabs. So, an investor falling in a 10% tax bracket would pay 10% tax on dividend income instead of 28%.

What are the Characteristics of Best Midcap Mutual Funds?

Before we discuss the best midcap mutual funds in 2021, we want to share with you a checklist. This checklist will help you evaluate and comb through bad midcap funds. Every best midcap fund must pass the below checklist before you invest in them.

Checklist for selecting best midcap funds–

- Best midcap mutual funds must have a performance track record of at least 10 years.

- Best midcap mutual funds must diversify their corpus across multiple midcap stocks.

- Best midcap mutual funds must not invest more than 50% of their corpus in top 10 stocks.

- Best midcap mutual funds must have an asset under management of more than Rs 500 crores. This will help it manage redemption pressure.

- Best midcap mutual funds must have a low expense ratio.

- Best midcap mutual fund must fall less than its benchmark during the bear market.

- Best midcap mutual funds must compensate for the high risk. Hence, aim for a midcap fund with high Sharpe and Sortino ratios.

- Best midcap mutual funds must create alpha over the benchmark.

- Best midcap mutual funds must have low turnover or churn ratio. Preferably less than 50%.

Outlook for Midcap Mutual Funds in 2021-22

The last few months have been exciting for midcap stocks and midcap mutual funds. The Nifty Midcap 100 index hit a lifetime high of 28,266 on 3rd August 2021. But what next?

As long as midcap companies are able to post good quarterly earnings and stay above the water till the pandemic is over, midcap funds would be a good investment bet.

But investors should invest in midcap funds only under the following two conditions –

- They have a high-risk profile

- Their investment horizon is more than 10 years. This will give midcap funds enough time to absorb losses or compound gains.

We would recommend investors to have adequate exposure to large cap, debt and gold mutual funds.

[Read More: 5 Best Gold Mutual Funds to Invest in 2021]

Best Midcap Mutual Funds in 2021-22

| Best Midcap Mutual Funds in 2021 | 1 Year | 3 Years | 5 Years | 7 Years | 10 Years | Expense Ratio | Turn over | Sharpe ratio | Sortino ratio | Alpha |

|---|---|---|---|---|---|---|---|---|---|---|

| Axis Midcap Fund | 64.23% | 23.40% | 21.29% | 17.41% | 21.34% | 1.85% | 22% | 0.86% | 0.87% | 6.38% |

| DSP Midcap Fund | 50.77% | 19.23% | 16.24% | 16.74% | 18.66% | 1.80% | 20% | 0.64% | 0.61% | 1.99% |

| L&T Midcap Fund | 51.94% | 14.33% | 15.79% | 16.07% | 19.32% | 1.87% | 6.02% | 0.43% | 0.44% | -2.78% |

Source – RankMF *Ranking as on 14th September 2021. **This is not investment advice.

1. Axis Midcap Fund is one the best midcap funds in 2021-22. It has generated 64.23% returns in the last one year (as on 14th September 2021). It has a stellar 10-year return of 21.34% against a benchmark return of 18.31%. The fund is bullish on financial (18.07%) and technology (12.99%) stocks.

Reasons why Axis Midcap Fund is the best midcap fund in 2021-22 –

- The AUM of Axis Midcap Fund is Rs 14,804 crores as on 14th September 2021. This is 220% higher than other midcap schemes. This will help it handle redemption pressure.

- The fund’s turnover ratio is 22% only. This is 69% lower than the midcap category average.

- Fund’s expense ratio is 1.85%. This is 52% lower than other midcap funds.

- The fund has generated an alpha of 6.38% over its benchmark.

- Axis Midcap Fund’s standard deviation (19.88%) is much lower than its benchmark (26.72%). So, the fund is taking comparatively less risk.

2. DSP Midcap Fund is the second best midcap fund in 2021-22. It has generated a stellar return of 50.77% in the last one year (as on 14th September 2021). Even its 10-year return is a whopping 18.66%. It is bullish on financial (17.78%), chemicals (13.77%) and consumer durables (8.95%) stocks.

Reasons why DSP Midcap Fund is the best midcap fund in 2021-22 –

- The fund’s AUM is Rs 13,773.75 crores. This is 198% higher than other funds in the midcap category average.

- Turnover ratio of the fund is 20% only. This is 74% lower than the midcap category average.

- Expense ratio of the fund is only 1.80%. This is 50% lower than the midcap category average.

- DSP Midcap Fund has generated an alpha of 1.99% over its benchmark.

- The fund has only 31.94% allocation to top 10 stocks.

- The fund’s standard deviation (22.30%) is much lower than the benchmark (26.72%).

3. L&T Midcap Fund is the third best midcap fund in 2021-22. It was launched in 2004. It has generated a spectacular 10-year return of 19.32%. The fund is bullish on the healthcare sector with 17.11% allocation.

Reasons why L&T Midcap Fund is the best midcap fund in 2021-22 –

- L&T midcap fund has one of the lowest turnover ratios of 6.02%. This is 92% lower than the midcap category average.

- The fund’s AUM is Rs 6,947.93 crores. This is 50% higher than other midcap funds.

- The fund’s expense ratio is 1.87%. This is 53% lower than other schemes in the midcap category.

- The fund has decent Sharpe (0.43%) and Sortino (0.44%) ratios.

- The fund has 8.78% exposure to small cap stocks. This makes it risky but perfect for aggressive investors.

How to Invest in the Best Midcap Mutual Funds 2021-22?

You can invest in the best midcap funds in 2021-22 in less than 15 minutes with RankMF. Follow the below steps to invest in the best midcap mutual funds in 2021-22.

- Open a FREE RankMF account in less than 15 minutes!

- Complete your Know your Customer (KYC) formalities. This will take you less than 5 minutes.

- Shortlist the best midcap funds from the above list.

- Register SIP or make lumpsum investments in your favorite midcap mutual fund and you’re done!

Leave A Comment?